India’s ecommerce industry is growing faster than ever. In 2025, it is expected to be worth ₹13 lakh crore ($151 billion), and by 2030, it could reach ₹29.8 lakh crore ($345 billion). This rapid growth is driven by more people using the internet, the rise of digital payments like UPI, and strong demand from smaller cities and towns.

India now has over 342 million online shoppers and nearly 6 lakh active ecommerce stores. Global companies like Amazon and local players like Flipkart and Meesho are all competing in this fast-changing market. From fashion and electronics to beauty and grocery delivery, online shopping is becoming a regular part of life for millions.

In this blog, you’ll find the latest data and insights on India’s ecommerce market size, top platforms, user behavior, digital payments, and more.

Highlights From The Post

- India’s ecommerce is valued at Rs. 13,04,703 crores ($151 billion) as of 2025.

- There are 342 million active ecommerce shoppers in India.

- India is expected to become the 3rd-largest online retail market by 2030.

- 60% of India’s internet users shop online almost every week.

Indian Ecommerce Market Size

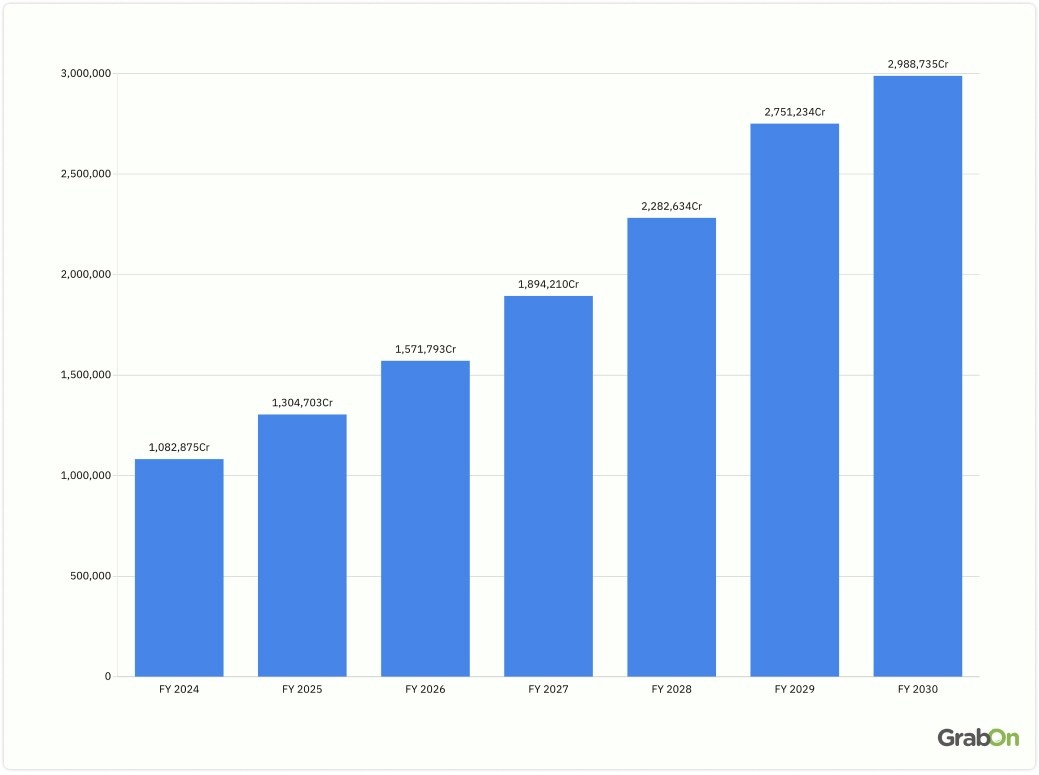

India’s e-commerce industry is valued at Rs. 13,04,703 crores ($151 billion) as of 2025, accounting for 8% of the country’s total retail market.

The indian ecommerce market will keep on growing at a compound annual growth rate of 20.5% until 2030 to reach a valuation of Rs. 29,88,735 crore ($345 billion).

| Fiscal Year | Value in INR | Value in USD |

| FY 2024 | Rs. 10,82,875 crores | $125 billion |

| FY 2025 | Rs. 13,04,703 crores | $151 billion |

| FY 2026 | Rs. 15,71,793 crores | $182 billion |

| FY 2027 | Rs. 18,94,210 crores | $219 billion |

| FY 2028 | Rs. 22,82,634 crores | $263 billion |

| FY 2029 | Rs. 27,51,234 crores | $317 billion |

| FY 2030 | Rs. 29,88,735 crores | $345 billion |

This expansion has been driven by wider internet access, a growing middle class, and the country’s rise of digital payment solutions. While it started in urban centers initially, e-commerce gained momentum in tier 2 and 3 cities, and more recently, in rural areas, where it’s beginning to reshape local economies and consumer behavior.

India’s Rank In Global Ecommerce

India is the 7th-largest e-commerce market in the world by value and has the second-highest number of internet users, with over 971 million people online. With this strong digital presence, India is expected to become the 3rd-largest online retail market by 2030.

| Country | Ecommerce Market Value |

| China | $3450 billion |

| United States | $1380 billion |

| United Kingdom | $195.7 billion |

| Japan | $169.4 billion |

| South Korea | $147 billion |

| Germany | $141.2 billion |

| India | $125 billion |

| Indonesia | $62 billion |

| France | $51 billion |

| Canada | $40.3 billion |

Number Of Ecommerce Shoppers In India

Nearly 342 million Indian individuals actively shop online as of 2025. There has been a net addition of 80 million digital shoppers in the last three years, meaning 26.6 million shoppers every year from the beginning of 2022.

It is estimated that India will be the world’s second-largest online consumer market by 2030, with approximately 600 million digital shoppers.

Number Of Ecommerce Stores In India

There are 580,820 active ecommerce stores in India as of 2025. Up by 563% since early 2020. This puts India in the 7th spot globally in terms of functioning ecommerce stores.

| Year | Number of Ecommerce Stores In India |

| 2019 | 33,305 |

| 2020 | 87,588 |

| 2021 | 103,827 |

| 2022 | 328,308 |

| 2023 | 493,839 |

| 2024 | 536,800 |

| 2025 | 580,820 |

68% of these stores run on the WooCommerce and Shopify platforms. WooCommerce holds a 21.7% market share (125,888 stores) while Shopify holds 18.6% market share (107,927 stores)

| Technology | Websites | Market share |

| WooCommerce Checkout | 125,888 | 21.7% |

| Shopify | 107,927 | 18.6% |

| Wix Stores | 46,560 | 8% |

| Digital Showroom | 28,771 | 5% |

| Squarespace Add to Cart | 3,848 | 0.7% |

The Growing Online Beauty and Personal Care Market in India

India’s Beauty and Personal Care market is growing quickly and is expected to reach a gross merchandise value of ₹2.6 lakh crore ($30 billion) by 2027. This would make up about 5% of the global beauty market.

With an annual growth rate of nearly 10%, it’s the fastest-growing BPC market among major economies. In the next seven years, third-party logistics providers are expected to handle around 17 billion shipments.

Insights On India’s Leading Ecommerce Marketplaces

Flipkart

The indigenous e-commerce giant Flipkart raised $1 billion in a new funding round, with its parent company, Walmart, anticipated to contribute $600 million. Google LLC is investing $350 million in Flipkart as part of a nearly $1 billion funding round led by Walmart Inc., Flipkart’s majority stakeholder, with the investment aimed at expanding Flipkart’s business and modernizing its digital infrastructure to serve customers across India.

- Flipkart controls 48% of India’s ecommerce market.

- Flipkart’s revenue stood at Rs 70,541.9 crores ($8.5 billion) in FY 2024.

- The platform holds 48% and 60% market share in the online smartphone and online fashion markets, respectively.

- Flipkart Group’s Myntra has over 50% market share in India’s fashion e-commerce segment in terms of active users.

Amazon India

- Amazon holds a 39% share of India’s ecommerce market.

- Amazon India’s total operating revenue stood at Rs 25,592.8 crore ($3.06 billion) in 2024, a 14.5% increase from FY 2023.

- Amazon offers 168 million products to its Indian Customers through 218.000 active sellers.

- Prime members in India received over 41 crore items with same-day or next-day delivery in 2024.

- Indian Prime members saved an average of over ₹3,300 on deliveries last year—more than twice the annual membership fee.

Meesho

- Meesho is backed by SoftBank and has positioned itself as the fastest-growing e-commerce platform in terms of user base in India.

- 120 million Indians shop on Meesho every month.

- Meesho has 37% of India’s ecommerce order volume.

- Meesho reported a 33% jump in operating revenue at Rs 7,615 crore in 2024.

Statistics On India’s Quick Commerce Sector

- India’s quick commerce market will have 60.6 million users by 2029. The current user base stands somewhere around 39.2 million.

- India’s quick commerce market revenue is expected to reach $5,384 million in 2025.

- Zomato-owned Blinkit has a 46% market share in India’s Q-commerce, Zepto is the second biggest player with 29%, and Swiggy-owned Instamart has a market share of 25%.

- Quick commerce will account for 2 to 3% of the total online retail sales in India by 2028.

Statistics on India’s Digital Payments

While only 13% of India’s ecommerce orders are cash on delivery, the rest 87% are paid through digital means. Let’s have a look at some statistics related to it in this section.

- More than 40% of all payments done in India are digital.

- India’s high mobile commerce usage makes digital wallets the primary online payment method, accounting for 46%. While 29% of shoppers use cards for online shopping.

- Over 390 million people use UPI in India, equivalent to 24% of the country’s population

- In 2024, UPI processed around 172 billion transactions, marking a 46% increase from 117.64 billion in 2023.

- Recent data indicates that IMPS transactions have surged, with 441 million transactions recorded in December 2024, compared to 407.92 million in November 2024.

Statistics On India’s Internet Usage

- There are 971.50 million internet users in India, equivalent to 67.03% of the country’s population.

- Internet users in India are expected to surpass the 1 billion mark by the end of 2025.

- 7 out of 10 Indians have internet access, with 58.25% accessing from urban areas and around 40% from rural regions.

- 60% of India’s internet users shop online almost every week.

- Smartphones account for 78.62% of India’s internet traffic, laptops/desktops for 20.95%, and tablets for 0.43%.

- On average, around 9 out of 10 Indian internet users spend about 1 hour and 30 minutes online daily, mainly on social media.