Quick Commerce represents the next evolutionary step in e-commerce, focusing on ultra-fast delivery times, often within 10 to 30 minutes of placing an order. In India, this sector has seen a significant surge, driven by the country’s rapid digitalization and the changing consumer demand for instant deliveries.

In 2024, India’s Quick Commerce sector is a rapidly growing market, valued at an impressive $3.34 billion and projected to grow at a CAGR of over 4.5%.

For a deeper understanding of this growing industry, read further and discover how India is leading the Q-Commerce revolution.

Quick Commerce Statistics 2025 – Top Picks

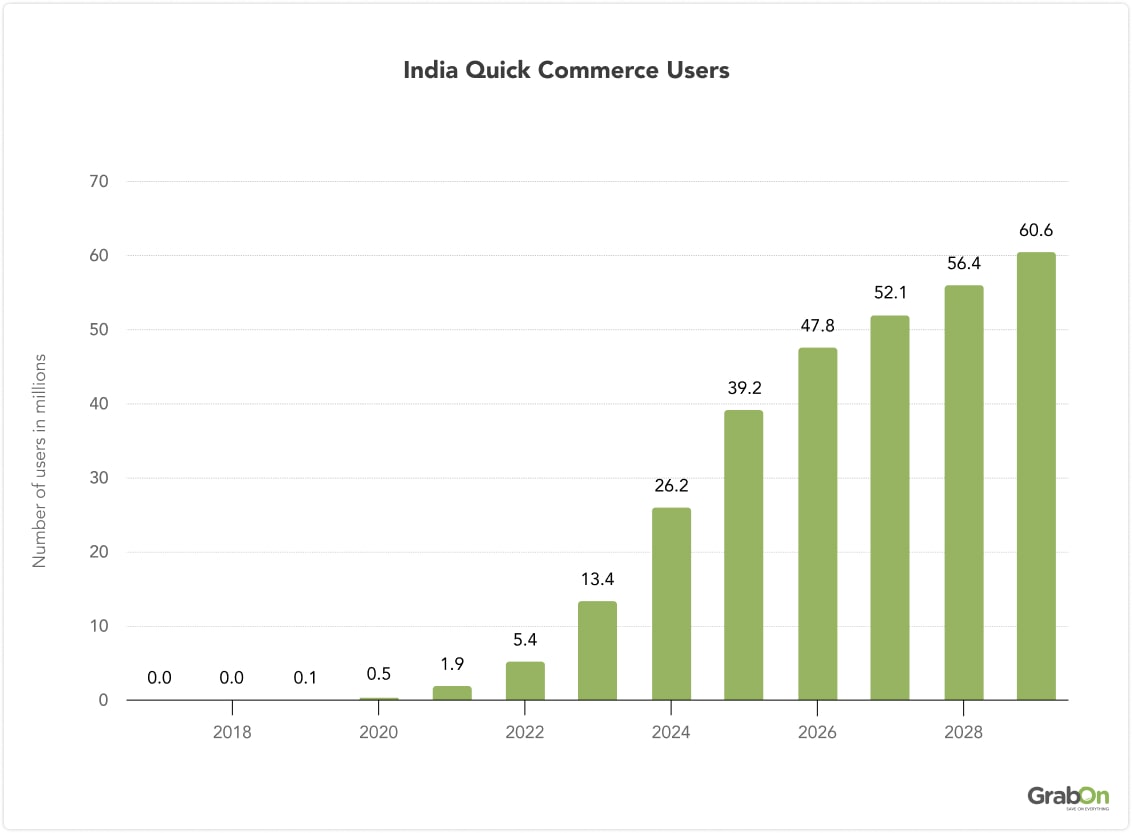

- India’s quick commerce market will have 60.6 million users by 2029.

- Q-commerce will see a projected 40-45% increase in user base over the next 3 years.

- Blinkit leads the quick commerce market in India with 46% of the market share by GMV.

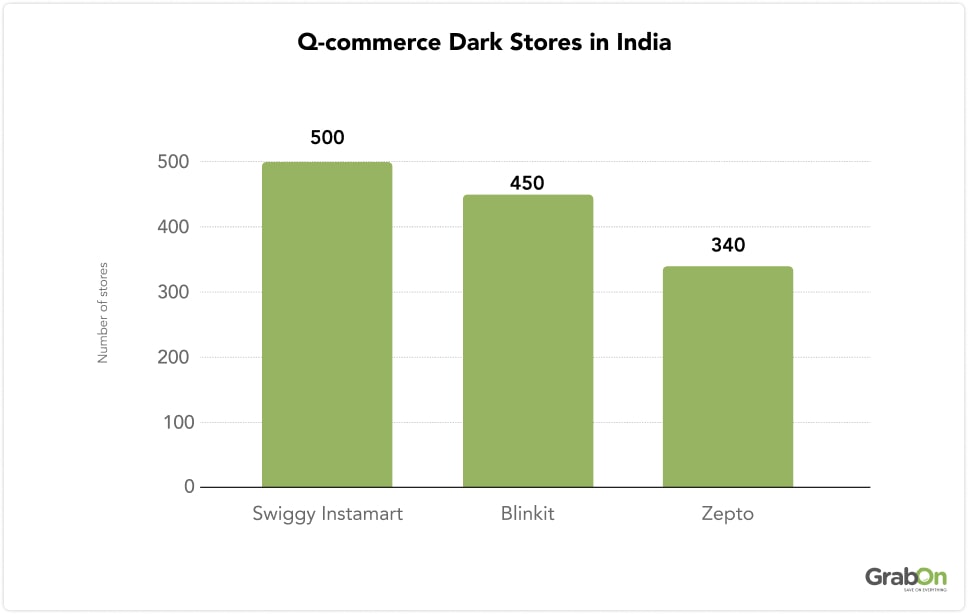

- Swiggy Instamart has over 500 dark stores in India, followed by Zepto.

- The 18-24 age group uses Quick Commerce apps & websites the most in India.

Quick Commerce Market Share Statistics

1. Swiggy Instamart has the highest number of dark stores across India. On the other hand, Zepto has over 300 dark stores.

2. By 2029, it is anticipated that the number of users in the Quick Commerce market in India will reach 60.6m users, suggesting a significant rise in consumer demand for convenient and time-saving delivery services.

3. As of Q1FY25, Zepto’s market share in India’s quick commerce sector is 29%, making it the second-largest player after Zomato-owned Blinkit, which has a 46% share by GMV.

Here’s a bonus tip: Use Blinkit coupons from GrabOn to get additional savings on your already discounted products!

4. Instamart, led by Swiggy, stands next to Zomato with a 27% market share. The later-joined player in the game, Zepto, has rapidly earned a significant place in the ground by securing a 7% share.

5. Blinkit receives about 6 lakh orders daily, while Swiggy Instamart and Zepto receive 5 lakh and 3 lakh orders, respectively.

6. Q-commerce companies are using geographical mapping technologies to open dark stores, which helps deliver more than 60% of orders in 40 minutes.

7. Q-commerce is likely to sustain 40-45% growth over the next ~3 years, riding on promising user growth potential.

(Source: Statista, Silicon India, Mordor Intelligence, redseer, livemint, Economic Times)

Quick Commerce User Statistics

8. India has 26.2 million Quick commerce users as of 2024. This number is projected to reach 60.6 million by 2029.

Qcommerce user penetration rate currently stands at 1.8% and is projected to rise to 4.0% by 2029.

This suggests that quick commerce is still in its early stages of development in India, but it is expected to grow rapidly in the coming years.

Here is a table showing the Quick Commerce User Penetration By Country:

| Country | 2022 | 2023 | 2024 | 2025* | 2026* |

| India | 0.4% | 0.9% | 1.8% | 2.7% | 3.3% |

| China | 15.6% | 18.6% | 21.4% | 23.9% | 26.1% |

| Singapore | 14.5% | 15.7% | 16.8% | 17.7% | 18.4% |

| USA | 13.1% | 14.8% | 16.4% | 17.5% | 18.4% |

| Norway | 10.9% | 12.7% | 14.6% | 16.2% | 17.5% |

10. China boasts the highest user penetration rate in the Quick Commerce market, projected to reach 26.1% by 2026.

11. Q-commerce brand Blinkit had a total visit of 8.8 million between January and March 2024, followed by BigBasket at 6.7 million and Zepto at 5.3 million.

(Source: Statista, similarweb)

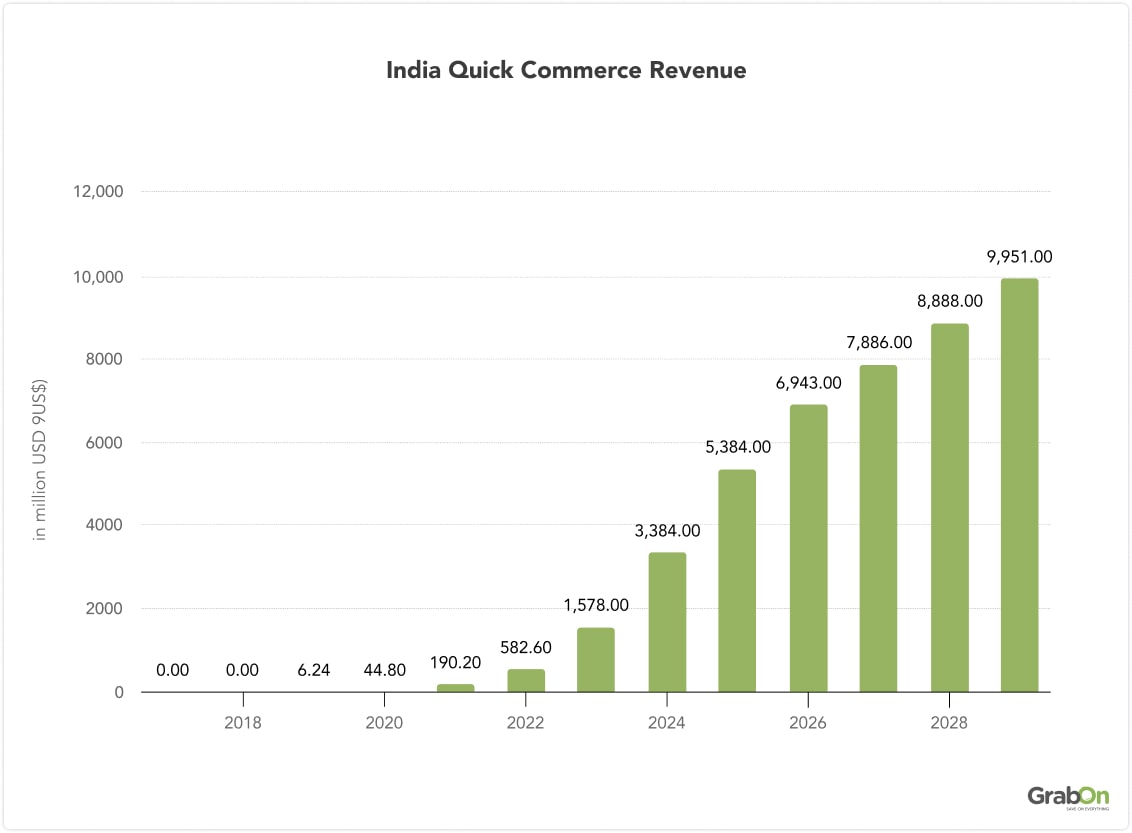

Quick Commerce Revenue Statistics

12. The Quick Commerce market worldwide achieved a revenue milestone of $170.80 billion in 2024. This growth trajectory demonstrates significant expansion, considering the estimated revenue of $142.40 billion in 2023. The market is projected to continue its upward trend, reaching approximately $195 billion in 2025. This continuous growth reflects the increasing demand and popularity of quick commerce services globally.

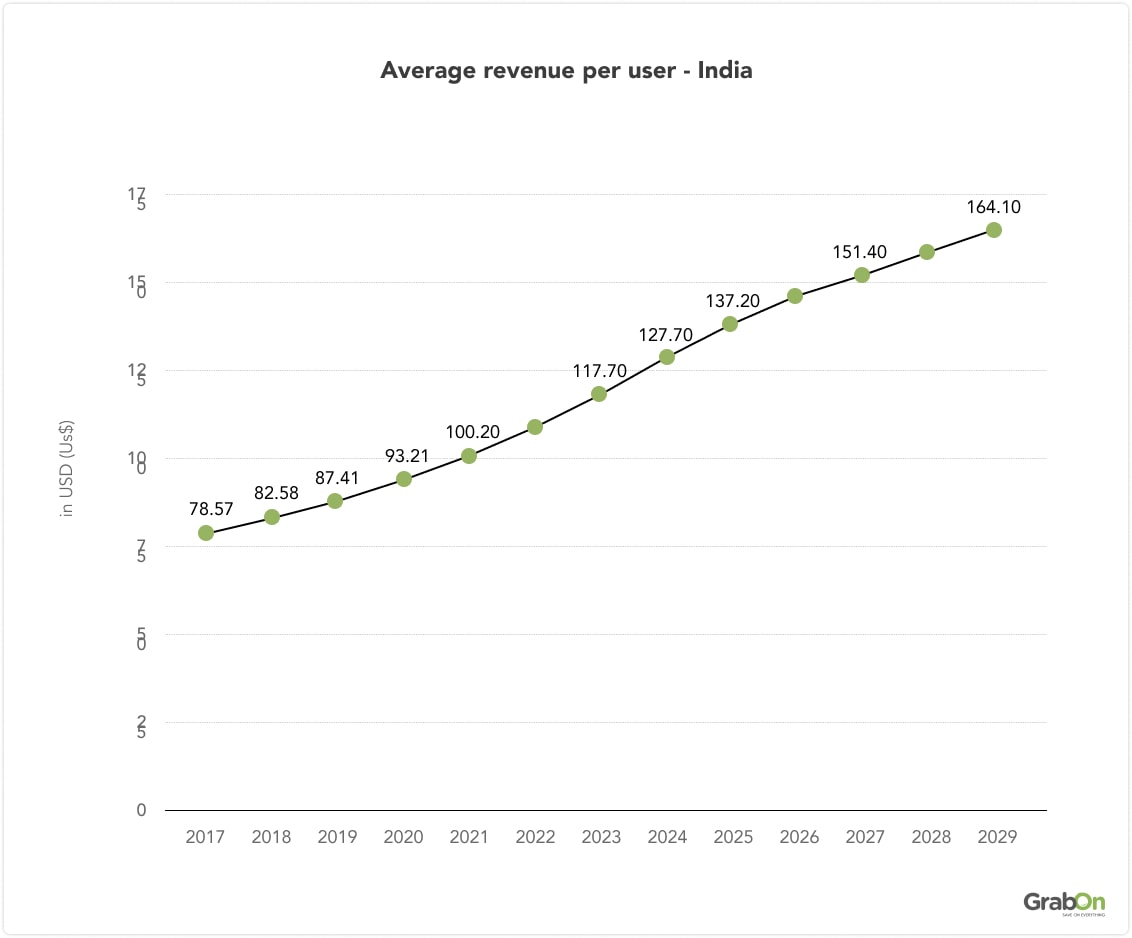

13. The average revenue per user (ARPU) in the Quick Commerce industry is estimated at $127.70.

14. From a global perspective, China is expected to generate the highest revenue in the Quick Commerce market, amounting to $80,840 million in 2024.

Here is a table showing Quick Commerce revenue in different countries:

| India | China | USA | Japan | South Korea | |

| 2022 | $0.58 billion | $52.76 billion | $39.89 billion | $2.69 billion | $2.07 billion |

| 2023 | $1.58 billion | $67.29 billion | $47.92 billion | $3.21 billion | $2.47 billion |

| 2024 | $3.35 billion | $80.84 billion | $56.52 billion | $3.77 billion | $2.85 billion |

| 2025 | $5.38 billion | $92.68 billion | $62.63 billion | $4.31 billion | $3.19 billion |

| 2026 | $6.94 billion | $102.60 billion | $68.35 billion | $4.80 billion | $3.46 billion |

15. India’s quick commerce market revenue is expected to reach $5,384 million by 2025. The country is experiencing rapid growth due to increasing smartphone penetration and a young tech-savvy population.

16. The average revenue per user in the Q-commerce industry has been increasing steadily over the past few years. In 2017, the average revenue per user was $78.57. By 2029, it is projected to be $175.

(Source: Statista)

(Source: Statista)

Quick Commerce User Demographics

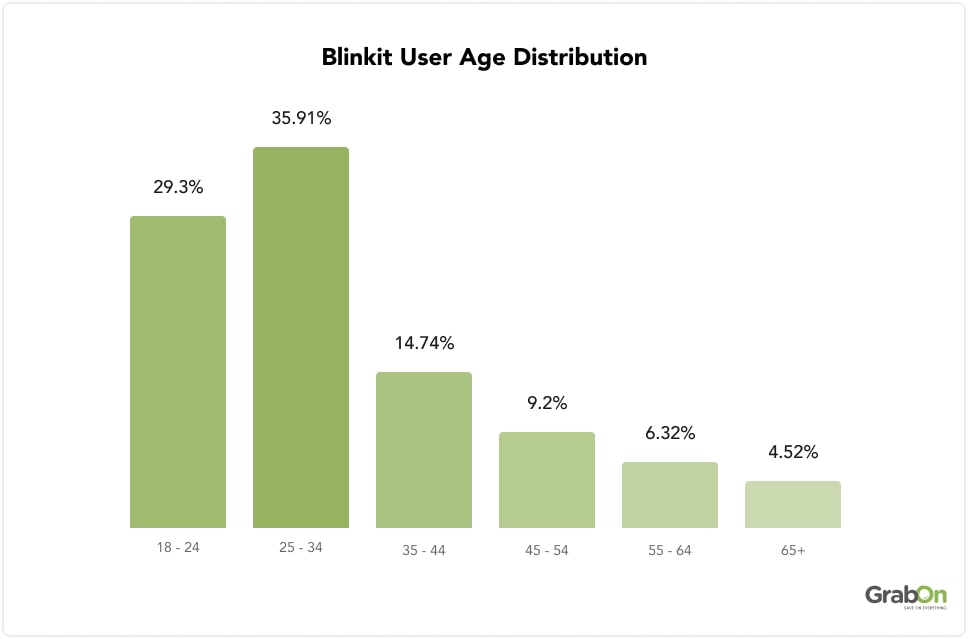

17. The 25-34 age group uses Blinkit the most followed by the 18-24 age group.

18. Blinkit has a user distribution of 62.57% male and 37.43% female.

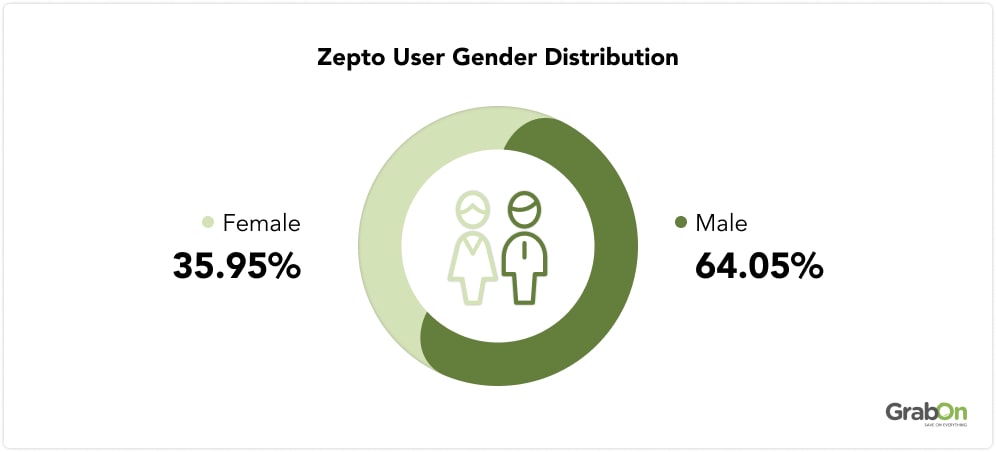

19. Zepto has 64.05 male users and 35.95 female users.

20. The 25-34 age group makes up 36.35% of the Zepto user base followed by the 18-24 age group at 28.73%.

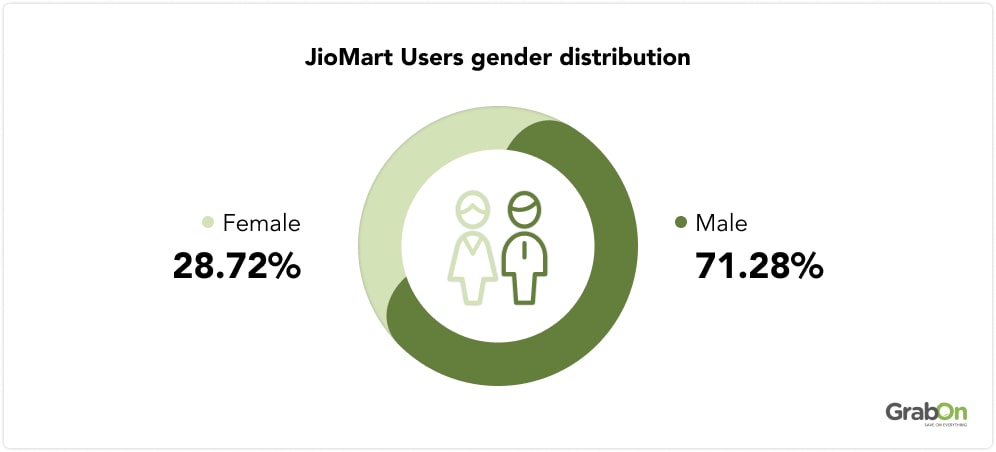

21. JioMart has a user base comprising 71.28% men and 26.72% women.

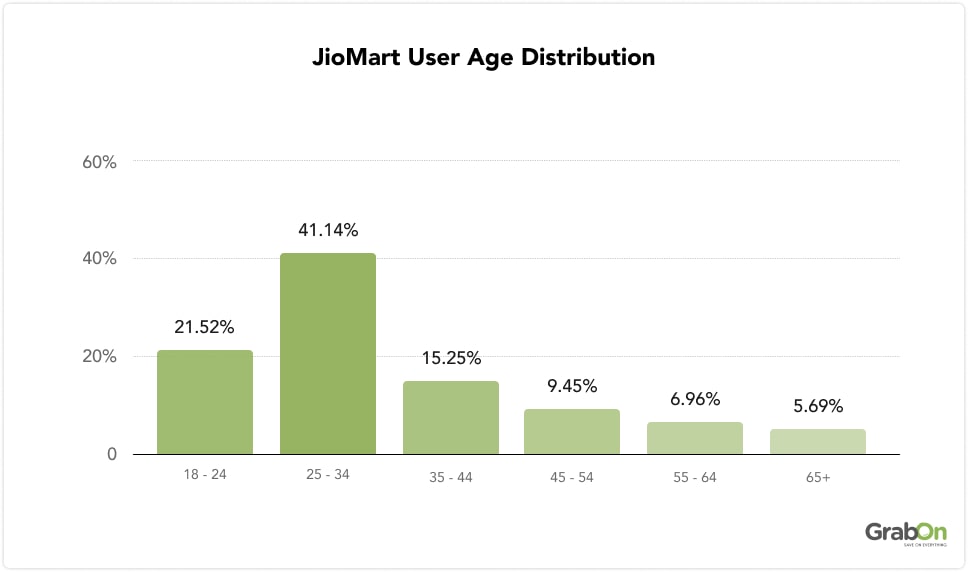

22. The largest group of JioMart users are between the ages of 18 and 24. This age group makes up 41.14% of users.

(Source: similarweb)

Quick Commerce Year-over-Year Growth Analysis

The quick commerce market has shown remarkable year-over-year growth. In 2022, the global market was valued at approximately USD 68.82 billion and is projected to grow at a compound annual growth rate (CAGR) of 22.2% from 2023 to 2030. This growth is driven by increasing consumer demand for rapid delivery of groceries, essentials, and other products.

In India, the quick commerce market is expected to generate USD 3.34 billion in revenue in 2024 and grow at a CAGR of 24.33% from 2024 to 2029.

This rapid growth is attributed to rising urbanization, increased internet penetration, and the convenience offered by quick commerce platforms.

(Source: Mordor Intelligence, Grand View Research)

FAQs on Quick Commerce

Quick commerce, also known as Q-commerce, is revolutionizing the way consumers shop by offering ultra-fast delivery of groceries, essentials, and other products, often within minutes. These QCommerce FAQs will provide clear and concise answers to some common queries.

What is the growth rate of quick commerce?

The global quick commerce market is experiencing rapid growth. It was valued at approximately USD 68.82 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 22.2% from 2023 to 2030.

In India, the quick commerce market is also expanding quickly. It is expected to generate USD 3.34 billion in revenue in 2024 and grow at a CAGR of 24.33% from 2024 to 2029.

How many people use quick commerce in India?

As of 2024, there are approximately 26.2 million quick commerce users in India. This number reflects the growing popularity of services like Blinkit, Swiggy Instamart, and Zepto, which offer rapid delivery of groceries and other essentials.

Can quick commerce be profitable?

Yes, quick commerce can be profitable by optimizing operations, leveraging technology, and diversifying revenue streams. Efficient logistics, private label products, and customer loyalty programs are key strategies to balance high operational costs with revenue, making the model sustainable and profitable despite challenges like high delivery costs and competition.

Who is the largest quick commerce?

Globally, Walmart is a leading player in the quick commerce market, leveraging its extensive logistics network and physical locations to reach a vast customer base. In India, major players include Swiggy Instamart, Blinkit, Dunzo, BigBasket, and Zepto, which together hold a significant market share

What is the market share of Zepto vs Swiggy?

As of Q1FY25, Zepto has a larger market share than Swiggy Instamart in the quick commerce sector. Zepto has a 29% market share while Swiggy Instamart has a 25% market share.