From its humble beginnings as an online bookstore, Amazon has evolved into the world’s largest online retailer, fundamentally changing global shopping and e-commerce practices. Amazon now serves a staggering 310 million customers worldwide and hosts over 2 million active sellers on its platform.

This blog post provides a comprehensive look at Amazon, highlighting key statistics such as its market share, user base, and revenue trends. Find out what makes Amazon a powerhouse in online retail and what’s driving its growth.

Amazon Statistics 2025 (Editor’s Picks)

- Amazon has 310 million active users and 9.7 million sellers worldwide.

- In 2023, Amazon generated a revenue of $574 billion, making it the world’s third-largest company by revenue.

- Amazon makes sales worth $16.3 million every second

- Amazon delivers about 1.6 million packages per day. That’s over 66,000 packages per hour and over 1,000 packages per minute.

- Amazon boasts over 230 million Amazon Prime members across 23 different countries.

Brief Overview of Amazon

| Amazon Founder | Jeff Bezos |

| Launch | July 16, 1995 |

| Headquarters | Seattle, Washington, United States |

| Valuation | $1.92 trillion |

| Industry | E-Commerce, Software Development |

Amazon leads in e-commerce market share

Amazon accounts for 37.6% of e-commerce sales in the US, the highest market share among all e-commerce companies. This puts it far ahead of its contenders, with Walmart at 6.4% of sales and eBay at 3%.

This growth is attributed to several factors, including the fact that 50% of consumers start their shopping journey on Amazon.

Here’s a table that shows the market share of top retail e-commerce companies in the US:

| Company | Market Share |

| Amazon | 37.6% |

| Walmart | 6.4% |

| Apple | 3.6% |

| eBay | 3% |

| Target | 1.9% |

| Home Depot | 1.9% |

| Costco | 1.5% |

| Best Buy | 1.4% |

| Carvana | 1.4% |

| Kroger | 1.3% |

Over 350 million products are sold on the Amazon Marketplace

Amazon offers a vast selection of over 350 million products, including those from third-party sellers. Additionally, Amazon sells more than 12 million products by itself.

Most popular Amazon categories among sellers

The top categories for Amazon sellers are home and kitchen, beauty and personal care, clothing, shoes, and jewelry.

Categories like Home & Kitchen and Beauty & Personal Care lead due to their broad appeal and consistent consumer spending, making shopping at Amazon a preferred choice for diverse needs.

To understand where Amazon sellers focus their efforts, here are the top categories based on their popularity:

| Amazon Category | Share of Sellers |

| Home & Kitchen | 35% |

| Beauty & Personal Care | 26% |

| Clothing, Shoes & Jewelry | 20% |

| Toys & games | 18% |

| Health, Household & Baby Care | 17% |

| Baby | 16% |

| Electronics | 16% |

| Sports & Outdoors | 16% |

| Pet Supplies | 13% |

| Office Supplies | 13% |

Source: ECDB

Why This Matters

These percentages indicate the proportion of Amazon sellers operating within each category, highlighting where seller focus, and consumer demand intersect most prominently. Categories like Home & Kitchen and Beauty & Personal Care lead due to their broad appeal and consistent consumer spending.

How many people shop on Amazon?

Amazon has over 310 million active users worldwide. More than 80% of these users are from the United States, accounting for over 230 million customers.

As many as 25% of Americans use Amazon for shopping at least once a week

As for what Americans are buying on Amazon, electronics and tech is the most popular category, with 55% of Americans shopping for these items on the site.

Other popular purchase categories include clothing and accessories (48%), toiletries and personal care items (42%), and kitchen and household essentials (41%).

Here’s a table that shows Amazon’s (.com) traffic from various countries:

| Country | Traffic Share |

| United States | 80% |

| India | 1.87% |

| Canada | 1.30% |

| United Kingdom | 1.18% |

| Japan | 0.97% |

Source: SimilarWeb

How many Amazon sellers are there?

Amazon has over 9.7 million sellers worldwide, of which more than 2 million are actively selling on Amazon in 2024.

Over 60% of sales in Amazon’s stores come from third-party or independent sellers – most of whom represent small and medium-sized businesses. Independent sellers in the U.S. sold more than 4.5 billion items – an average of 8,600 every minute

Business owners choose to sell on Amazon due to the exceptional value it offers. They gain access to a large customer base, powerful tools, services, and programs that can fuel their business growth, often at a lower cost than other alternatives.

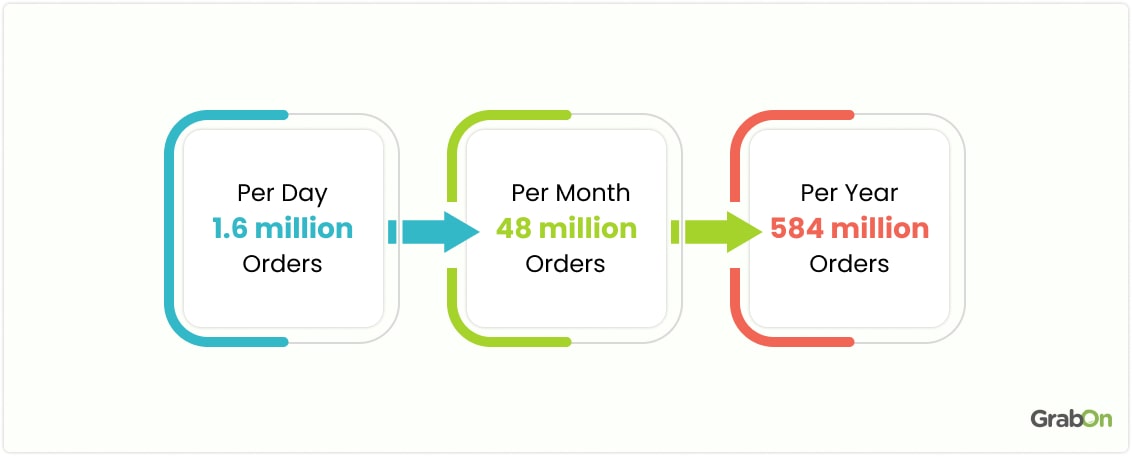

Amazon ships close to 1.6 million packages each day

Amazon ships approximately 1.6 million orders per day, which translates to 66,000 orders per hour or over 1,000 orders per minute. That’s an impressive volume of packages moving through their system.

| Time Period | Orders |

| Per Day | 1.6 million |

| Per Month | 48 million |

| Per Year | 584 million |

Amazon makes about $1.6 billion in sales a day

In 2023, Amazon’s total revenue surged to an astonishing $575 billion, marking a substantial increase from the previous year’s $514 billion. When this figure is spread across 365 days, it amounts to $1.6 billion in daily sales. This signifies Amazon’s phenomenal growth and continued dominance in the e-commerce and retail sectors.

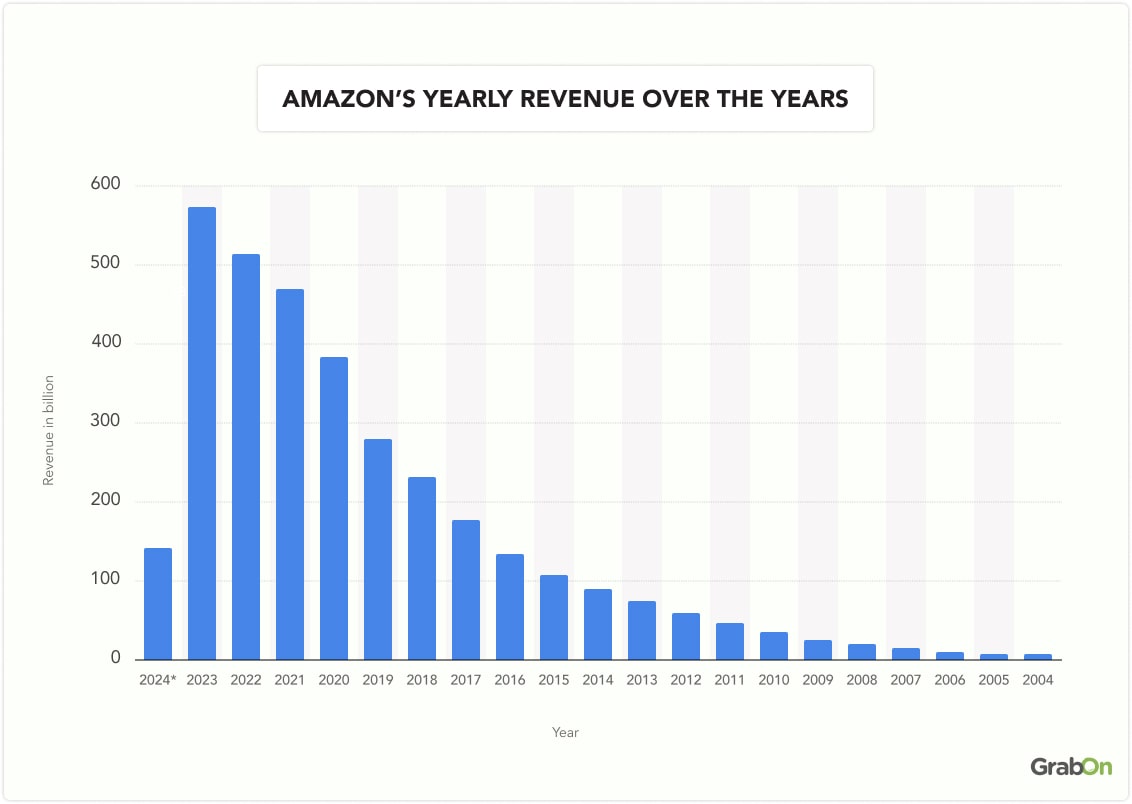

Amazon Revenue

In the first quarter of 2024, Amazon reported $143.3 billion in revenue. Its profit more than tripled to $10.4 billion, topping Wall Street expectations.

In the second quarter, net sales increased by 10%, reaching $148.0 billion compared to $134.4 billion in the same period in 2023

In the third quarter, net sales increased by 11% to $158.9 billion, compared with $143.1 billion in the third quarter of 2023.

In the fourth quarter of 2024, net sales increased 10% to $187.8 billion, compared to $170 billion in the fourth quarter of 2023.

Amazon grew by double digits for the sixth consecutive quarter at a $620 billion revenue run rate.

In 2023, Amazon made a whopping $574 billion, positioning it as the third-largest company globally in terms of revenue.

Here’s a table showing Amazon’s yearly revenue over the years:

| Year | Annual Revenue (in USD) |

| 2024 (Q4) | $187.8 billion |

| 2024 (Q3) | 158.9 billion |

| 2024 (Q2) | 148.0 billion |

| 2024 (Q1) | 143.3 billion |

| 2023 | 574.78 billion |

| 2022 | 513.98 billion |

| 2021 | 469.82 billion |

| 2020 | 386.06 billion |

| 2019 | 280.52 billion |

| 2018 | 232.89 billion |

| 2017 | 177.87 billion |

| 2016 | 135.99 billion |

| 2015 | 107.01 billion |

| 2014 | 88.99 billion |

| 2013 | 74.45 billion |

| 2012 | 61.09 billion |

| 2011 | 48.08 billion |

| 2010 | 34.2 billion |

| 2009 | 24.51 billion |

| 2008 | 19.17 billion |

| 2007 | 14.84 billion |

| 2006 | 10.71 billion |

| 2005 | 8.49 billion |

| 2004 | 6.92 billion |

Source: Amazon

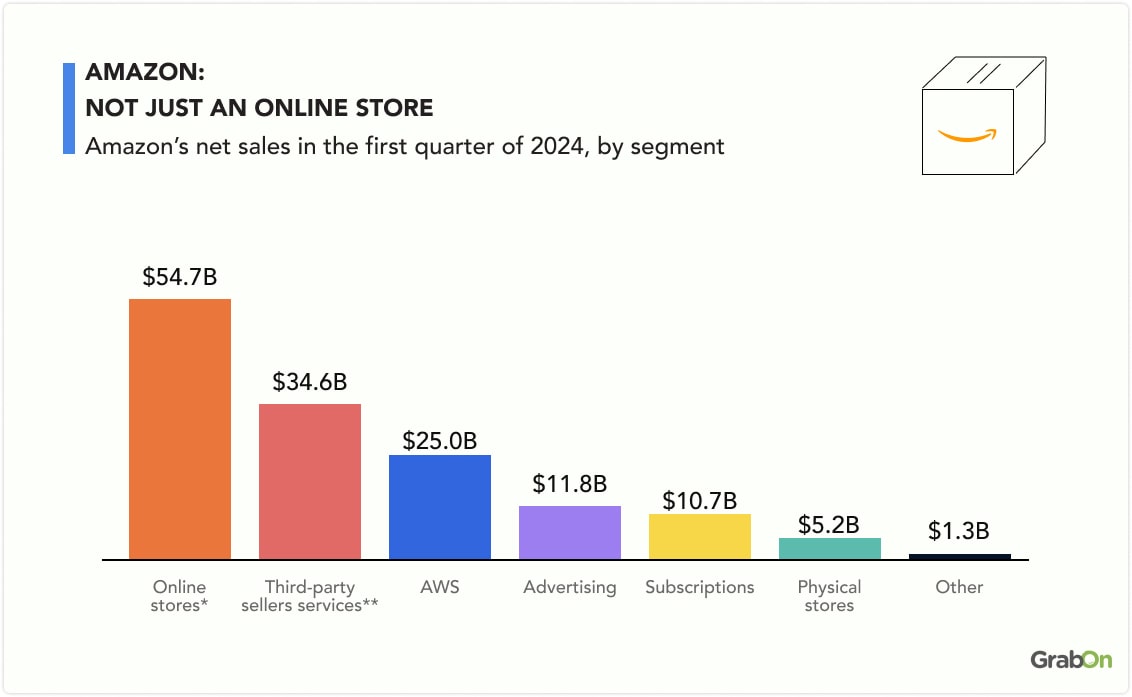

Amazon Revenue By Segment

According to recent data, while retail is Amazon’s primary revenue driver, accounting for about 38% of its total sales in Q1 2024, the company’s expansion into other segments is notable.

For instance, Amazon Web Services (AWS) is the largest cloud computing service in the world. Its sales improved 17% year-on-year to land at $25 billion in Q1 2024.

In Q1 of 2024, Amazon’s net sales from its third-party seller services amounted to $34.6 billion, up about 16% from the previous year.

In Q2 of 2024, the North American segment saw a 9% year-over-year increase in sales to $90.0 billion, while the international segment sales grew by 7% to $31.7 billion.

Amazon Web Services (AWS) also performed well, with a 19% increase in sales to $26.3 billion.

Amazon’s revenue also comes from physical stores, advertising, and subscriptions.

Here’s a chart that shows Amazon’s net sales for Q1 2024 by segment:

The table below shows Amazon’s revenue breakdown by segment between 2017 to 2023. (In billion US dollars)

| Year | Online Stores | Third-Party Retail | AWS | Advertising | Subscription Services | Physical Stores | Other |

| 2017 | 108.3 | 31.8 | 17.4 | – | 9.7 | 5.8 | 4.6 |

| 2018 | 122.9 | 42.7 | 25.6 | – | 14.1 | 17.2 | 10.1 |

| 2019 | 141.2 | 53.7 | 35 | – | 19.2 | 17.1 | 14 |

| 2020 | 197.2 | 80.4 | 45.3 | 15.5 | 25.2 | 16.2 | 5.9 |

| 2021 | 222 | 103.3 | 62.2 | 31.1 | 31.7 | 17 | 3.4 |

| 2022 | 220 | 117.7 | 80 | 37.7 | 35.2 | 18.9 | 4.2 |

| 2023 | 231.8 | 140 | 90.7 | 46.9 | 40.2 | 20 | 4.9 |

Source: Amazon

Amazon Prime Statistics

One of the main factors contributing to Amazon’s success is its subscription service, Amazon Prime, which provides free and fast delivery, exclusive discounts, and more.

Let’s look at some key statistics that highlight the impact of Amazon Prime on the e-commerce industry.

Amazon has over 230 million Prime members around the world

There are over 230 million Amazon Prime members worldwide and 173 million in the US.

The average Prime subscriber spends about $1,400 dollars a year.

Amazon Prime Day 2024 sales accounted for $14.2 billion

In 2024, sales during Prime Day reached a new record high, amounting to $14.2 billion, up by 10.07% from the previous year.

During the two-day shopping event, Prime members bought over 375 million items globally and saved more than $2.5 billion across the Amazon store, making it the largest Prime Day event ever.

Amazon Prime Day 2024 saw a record-breaking $14.2 billion in sales.

Amazon Prime Day 2024 set a new record with $14.2 billion in sales, an 11% increase from 2023’s $12.9 billion. The two-day event on July 16 and 17 saw significant consumer participation, with $7.2 billion spent on the first day and $7 billion on the second.

Key factors included aggressive discounts, strategic marketing, and a growing Prime membership. The top-selling categories were electronics, apparel, and furniture. Amazon’s AI assistant, Rufus, and independent sellers also contributed to the success, with over 200 million items sold.

| Year | Prime Day Sales |

| 2015 | $0.9 billion |

| 2016 | $1.52 billion |

| 2017 | $2.41 billion |

| 2018 | $4.19 billion |

| 2019 | $7.16 billion |

| 2020 | $10.4 billion |

| 2021 | $11.2 billion |

| 2022 | $12 billion |

| 2023 | $12.9 billion |

| 2024 | $14.2 billion |

Source: Statista

Revenue from Prime Membership Services

Amazon generated $44.3 billion in revenue through its Prime membership services in 2024.

Amazon Prime Video is the second-largest streaming service globally

As of 2025, Amazon’s premium video service has a massive global presence with more than 200 million monthly viewers. It ranks second to Netflix, which has over 269.6 million viewers.

Prime Video is available in more than 200 countries and regions around the globe.

Wrapping Up

In 2025, Amazon’s dominant position in global e-commerce is undeniable. With a customer base of over 310 million and a significant 37.6% share of e-commerce sales in the US, Amazon continues to set the standard for online retail.

In the future, Amazon’s investments in technology and delivery are expected to make it work better and give customers a better experience. As people change how they buy things and more things are sold online, Amazon’s ability to adjust and innovate will be key to staying ahead.