Influencer marketing in India has a storied past and a bright future. As far back as 1922, when Godrej launched its No.1 soap, the brand secured powerful endorsements from icons like Rabindranath Tagore. Brands and influencers have always had a long-standing relationship. Today, influencer marketing is booming in India, with a projected growth of 25% 2025 reaching INR 68.75 billion and potentially INR 107.5 billion by 2027.

With 50% of mobile engagement centered on social media, the question arises: who will emerge as the leading influencers in India, defining the standard, and what trends can we expect in this swiftly changing domain? Read on to explore insightful Influencer Marketing trends in India and what the future holds for it.

Key Influencer Marketing Statistics 2025 (Highlights)

- The influencer market in India is projected to grow at a CAGR of 25%, reaching INR 68.75 billion by 2025. By 2027, it is expected to further increase to INR 107.5 billion.

- India boasts 2.5 to 3.5 million content creators across social media platforms.

- 92% of influencers prefer short-form videos, with YouTube Shorts and Instagram Reels dominating.

- 47% of brands prefer Micro and Nano influencers for cost-effective campaigns.

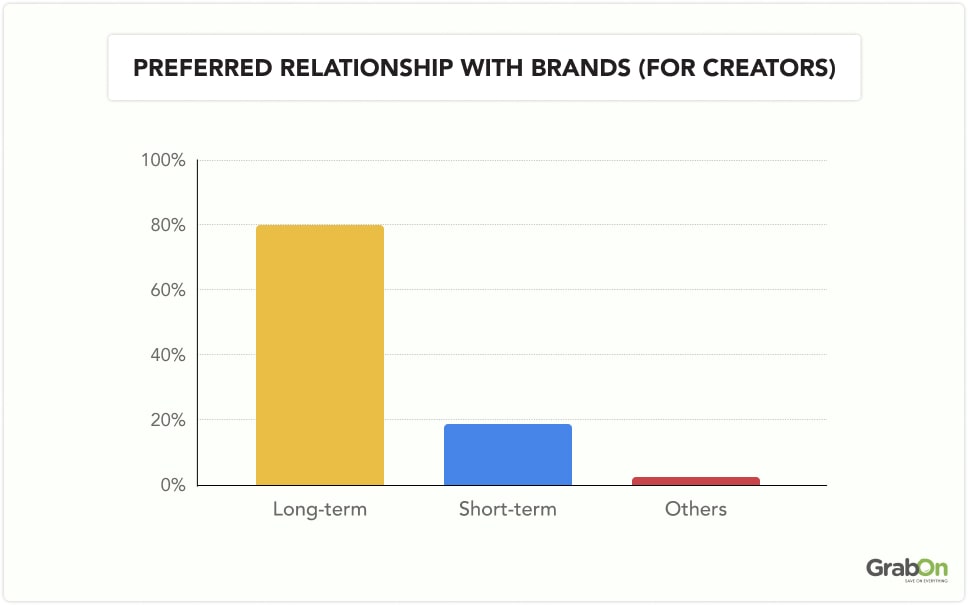

- 80% of influencers prioritize long-term brand relationships for enhanced engagement.

What Is The Market Size Of Influencer Marketing In India?

The market size of influencer marketing in India is projected to reach INR 68.75 billion by 2025, reflecting a significant growth of 439% from INR 12.75 billion in 2022. By 2027, it is expected to further expand to INR 107.5 billion, with a compound annual growth rate (CAGR) of 25% until 2026.

Go through the table below for a detailed overview of the market value of India’s influencer marketing industry from 2021 to 2027 (projected):

| Year | Market Value (in Indian rupees) |

| 2027* | 107.5 billion |

| 2026* | 28 billion |

| 2025* | 68.75 billion |

| 2024* | 55 billion |

| 2023* | 16.38 billion |

| 2022 | 12.75 billion |

| 2021 | 9 billion |

Source: Statista

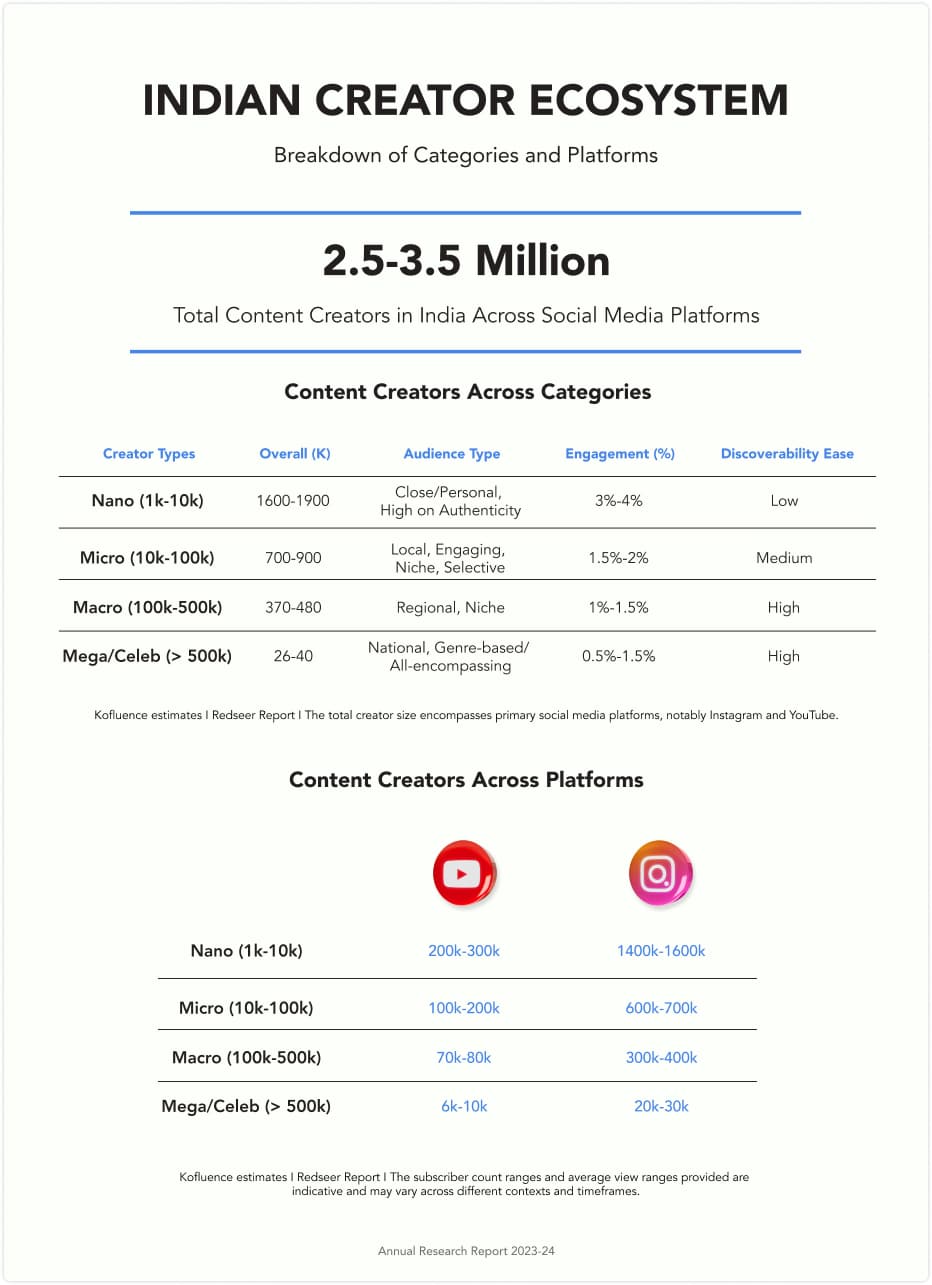

How Many Content Creators Are There In India?

The number of content creators in India is estimated at 2.5 to 3.5 million, on platforms like YouTube and Instagram. These creators are categorized based on their audience size and engagement levels:

- Nano-influencers typically engage with 1,000 to 10,000 followers.

- Micro-influencers cater to audiences ranging from 10,000 to 100,000.

- Macro influencers usually command a following of 100,000 to 500,000.

Mega or Celebrity influencers boast audiences exceeding the 500,000 mark.

Around 47% of brands prefer using nano and micro-influencers for their influencer marketing campaigns as they offer a lower cost per reach. Conversely, larger brands often choose mega influencers with over a million followers. Approximately 7,000 major brands collaborate with mega influencers boasting follower counts exceeding 1M.

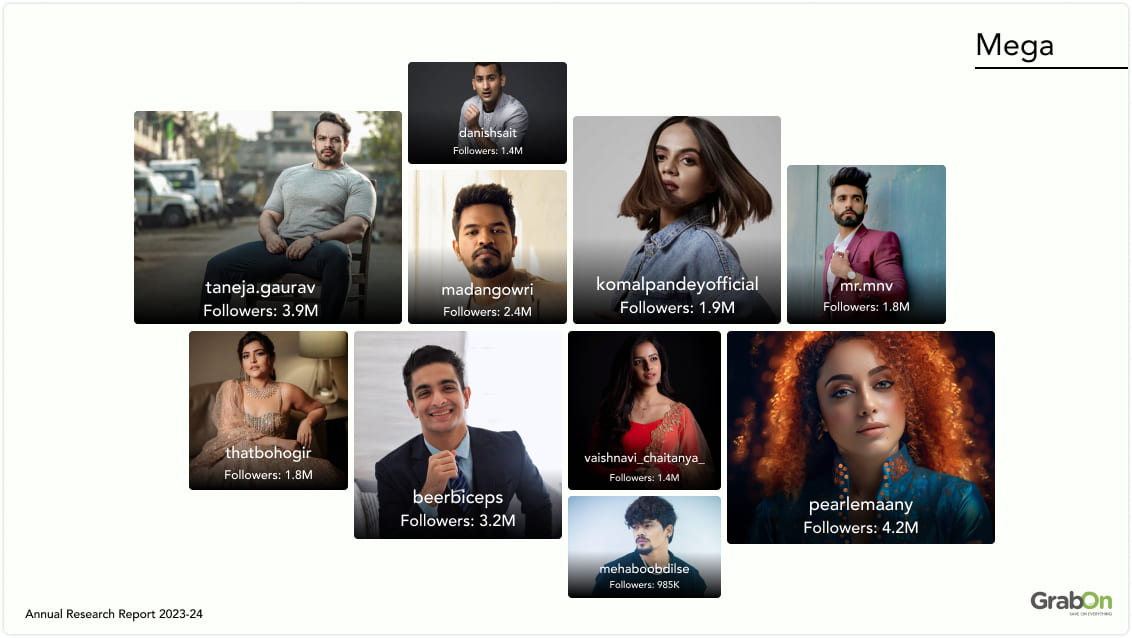

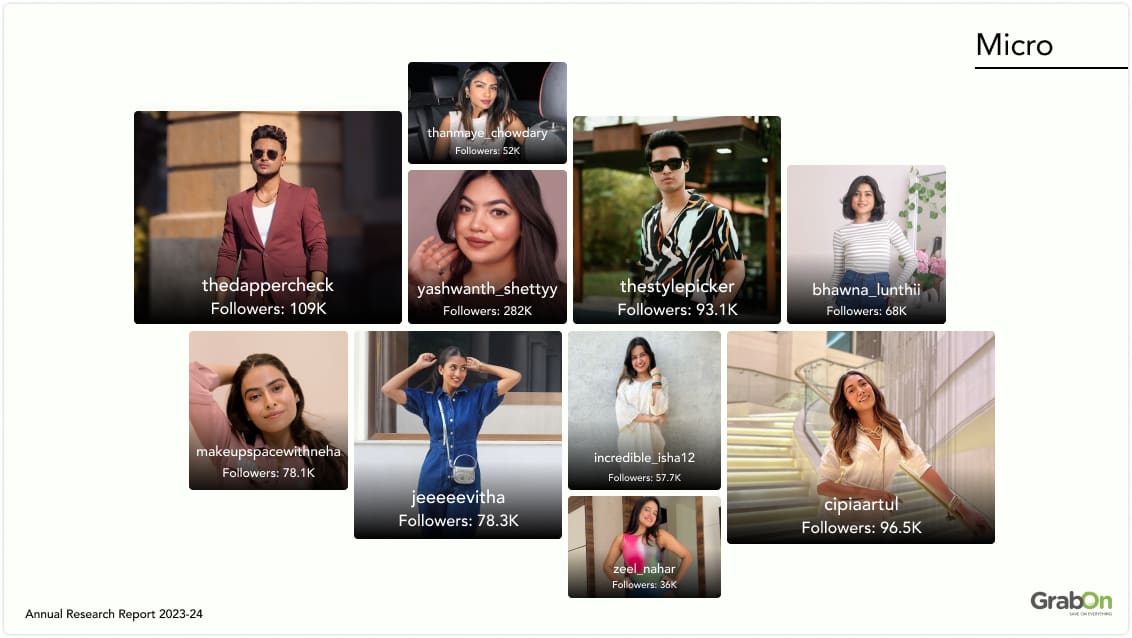

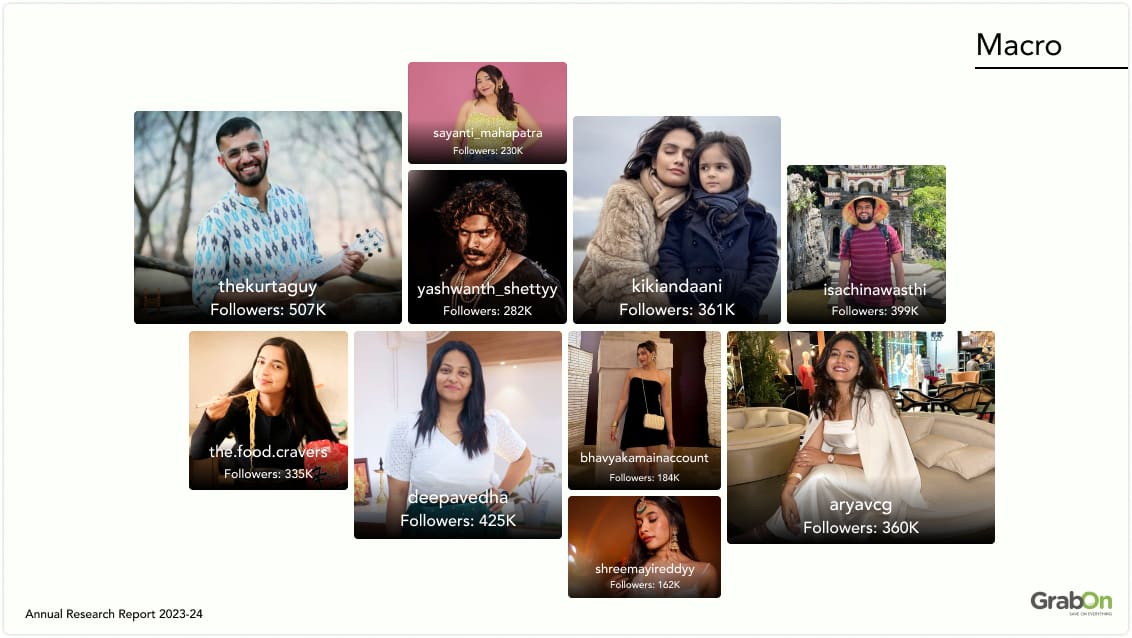

Here is a comprehensive breakdown of the Creator Ecosystem in India, featuring influencers from various categories and platforms:

Source: Kofluence

Instagram & YouTube lead Influencer content consumption in India

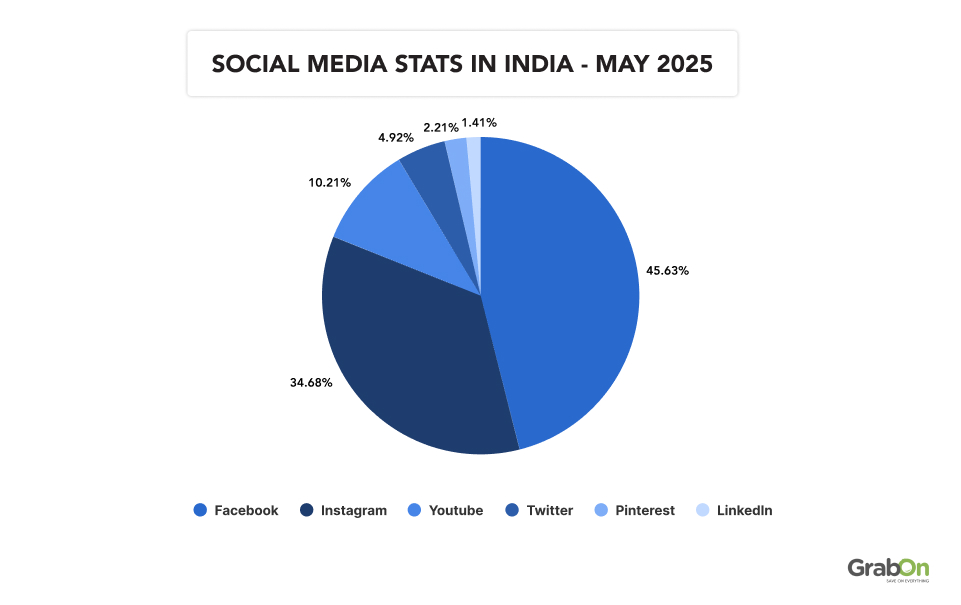

In India’s dynamic social media scene, Instagram is the most preferred platform for content consumption with an impressive 34.68% market share, reflecting its user engagement. However, Facebook is leading with a 45.63% share, indicative of its extensive reach and impact. YouTube maintains a strong presence with 10.21%, continuing to facilitate content sharing and social connectivity.

Interestingly, other social media platforms like Twitter, Pinterest and LinkedIn are also gaining traction, with market shares of 4.29, 2.21% and 1.41% respectively.

Source: Statcounter

Instagram Influencer Audience by Age Group

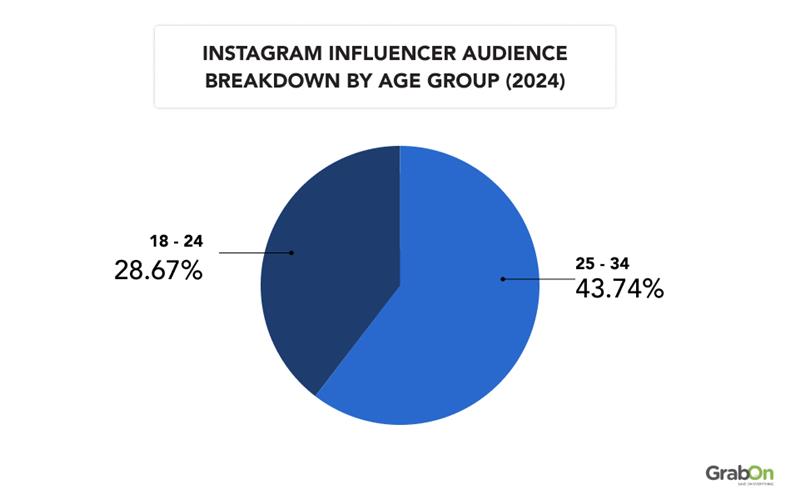

Instagram’s influencer audience is predominantly young: 43.74% are aged 25–34, and 28.67% are 18–24, highlighting its strong appeal among Millennials and Gen Z.

Source: Sprout Social

Preferred Influencer Content Formats

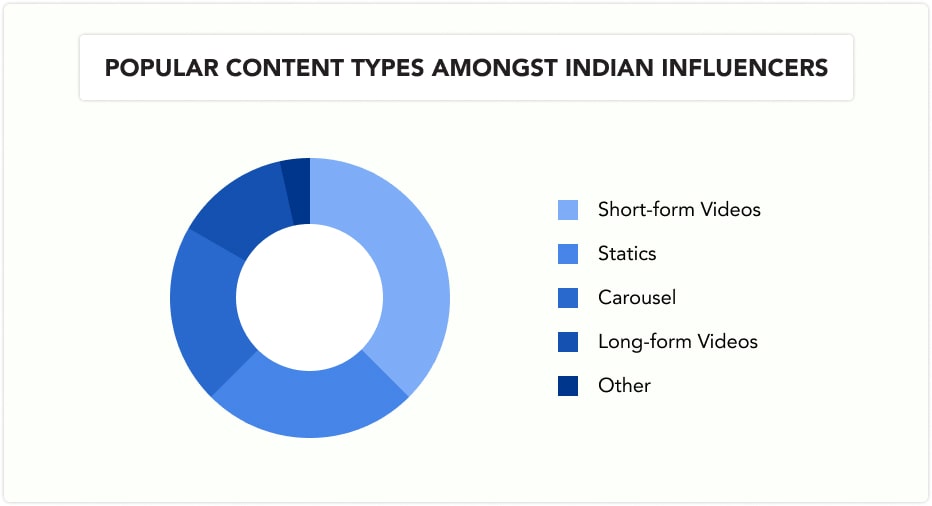

Short-form video content has become the top choice for influencers with 92% of influencers opting for the same, particularly with the rising popularity of YouTube shorts and Instagram reels. YouTube Shorts are the preferred mode, with 51% of influencers creating content on the platform, while 35.5% opt for Instagram Reels, although many use both formats.

Source: Influencer

Here is a table showing the type of content that content creators favor:

| Content-Type | Share Of Content Creators |

| Short-form Videos | 92.20% |

| Statics | 55.90% |

| Carousel | 50.40% |

| Long-form Videos | 37.30% |

| Other | 6.40% |

Top Influencer Choices For Brand Campaigns

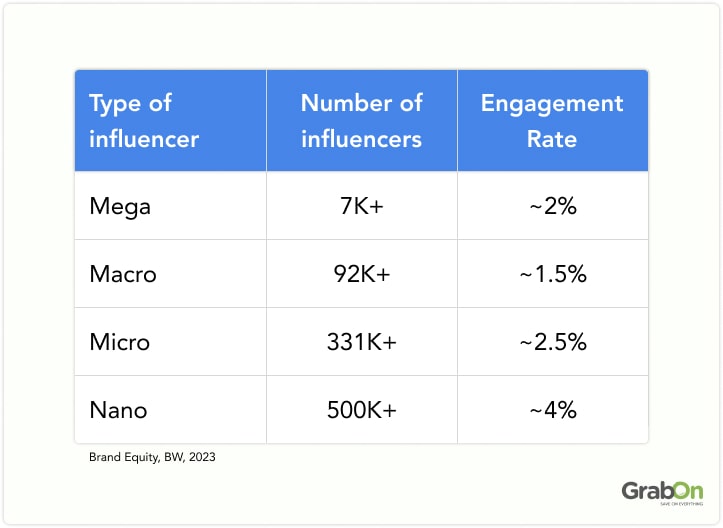

For marketers, finding the right mix of influencers is key — big names to boost brand awareness and smaller ones to engage with customers. Almost half of all brands(47%) choose micro and nano influencers because they’re cost-effective and have engagement rates of 2.5% and 4% respectively. On the flip side, larger influencers have lower engagement rates: 2% for mega and 1.5% for macro influencers.

When it comes to influencing purchases, celebrity endorsements and influencer content have a significant impact, collectively influencing 69% of consumer decisions, while e-commerce ads only influence 31%.

Source: E&Y

How Brands Spend On Influencer Marketing In India

According to EY surveys of marketers, 56% of brands have allocated over 2% of their marketing budget towards influencer marketing initiatives. Additionally, 70% of surveyed brands intend to maintain or boost their influencer marketing expenditure in 2024. Half of these brands plan to increase their influencer marketing budget by up to 10%, indicating a growing recognition of the effectiveness and value of influencer partnerships in brand promotion strategies.

How Brands Adopt Influencer Marketing Strategies

Brands prioritize influencers based on engagement rate and the quality of the target audience. Around, 61% of brands preferred driving awareness and engagement through influencer campaigns. 75% of brands view influencer marketing as integral to their overall marketing strategy. Given these insights, brands must ensure that their influencer selection criteria align closely with their campaign objectives.

Source: E&Y

Influencers And Brand Collaborations

Influencers overwhelmingly prioritize enduring partnerships with brands, with 80% preferring long-term relationships over one-off collaborations. They view ongoing associations as beneficial for fostering rapport and familiarity with brands, suggesting a desire for deeper connections rather than transactional engagements.

However, challenges arise as 57% of influencers report budget misalignment, indicating a disconnect between expectations and resources. Additionally, 51% of male influencers feel brands overly emphasize short-term metrics, while 40% highlight tight timelines as problematic. Despite these challenges, influencers believe that long-term relationships offer mutual benefits, enabling a better understanding of the brand and the creation of high-quality, on-brand content.

This table highlights the Preferences & Challenges faced by Indian Influencers –

| Influencer Preferences/Challenges | Influencer Count |

| Preference for Long-term Brand Relationships | 80% |

| Find Budget Misalignment a key challenge | 57% |

| Feel brands focus on Short-term Metrics (Male) | 51% |

| Citing tight timelines from brands as an issue | 40% |

Establishing long-term relationships enables influencers to gain a deeper understanding of the brand, fostering the creation of higher-quality, on-brand content. In turn, brands reap the benefits of continuity.

Source: Influencer.in

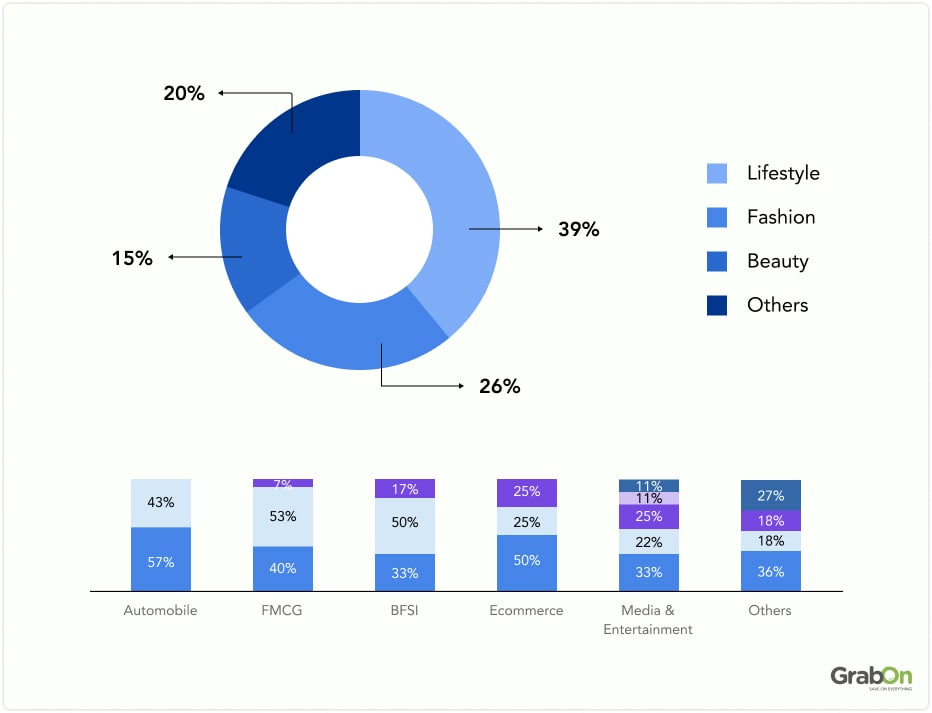

Key Sectors Driving Influencer Marketing Growth

Lifestyle, fashion, and beauty sectors are poised to be the primary drivers of growth in influencer marketing, with percentages of 39%, 26%, and 15% respectively. Additionally, other sectors are anticipated to contribute 20% to this growth. Furthermore, automobile, e-commerce, and FMCG industries are projected to see the most significant increase in spending on influencer marketing initiatives, signaling a shift towards leveraging influencer partnerships across diverse sectors for enhanced brand visibility and engagement.

Source: E&Y

Top Influencer Content Genres in India

More than 50% of Indian consumers prefer watching comedy content on social media, which makes it the top genre for influencers. Film & TV also garnered significant interest, with 50% of the respondents showing interest. Musical content came in third with a 48% preference. Surprisingly, VIPs & Celebrities ranked the lowest in preference, garnering only 19%.

This data provides insights into the influencer landscape and consumer preferences in the Indian market.

| Characteristic | Share of Respondents |

| Comedy | 58% |

| Film & TV | 50% |

| Music | 48% |

| Business & Economy | 47% |

| Food (e.g., mukbangs) | 44% |

| Health & Fitness | 44% |

| Science & Technology | 43% |

| Cars / Vehicles | 42% |

| Shopping / Product Reviews | 41% |

| Animal & Nature | 40% |

| Sports | 39% |

| Advice & Self-Help | 37% |

| Gaming & E-Sports | 35% |

| Family & Parenting | 33% |

| News & Politics | 32% |

| Adult Content | 30% |

| History | 29% |

| Love & Relationships | 28% |

| Society & Culture | 26% |

| Personal Finance | 25% |

| Religion & Philosophy | 21% |

| True Crime & Law | 19% |

| VIPs & Celebrities | 19% |

| No Content Consumption | 1% |

| Other | 3% |

| Don’t Know | 0% |

Source: Statista

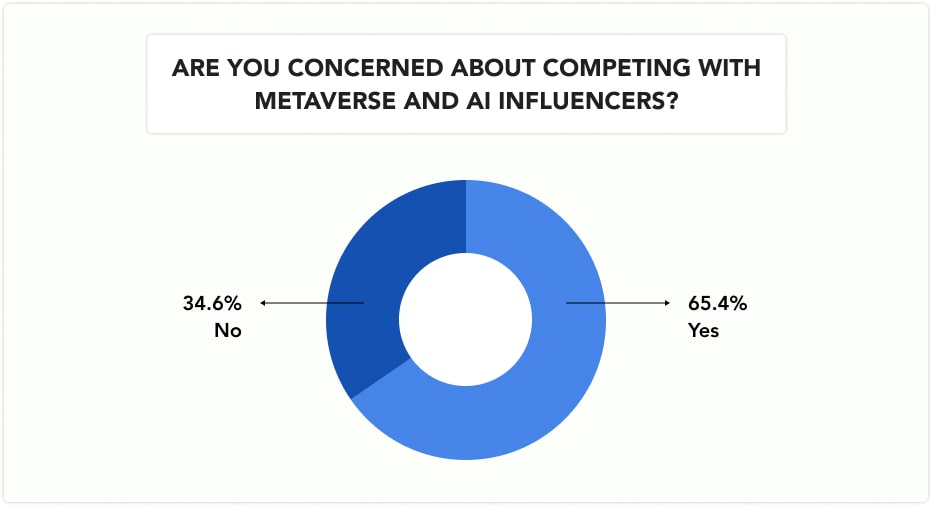

Influencer Marketing And AI

Influencers are increasingly integrating AI into their marketing strategies, with 50% utilizing AI for content ideation and 33% for engagement and writing assistance. However, 64% express concerns about competition from AI influencers, indicating a growing awareness of the impact of artificial intelligence on the influencer landscape. Additionally, a survey reveals that 65.4% of respondents are apprehensive about competing with Metaverse and AI influencers, highlighting the shifting dynamics within the industry.

Source: Influencer.in

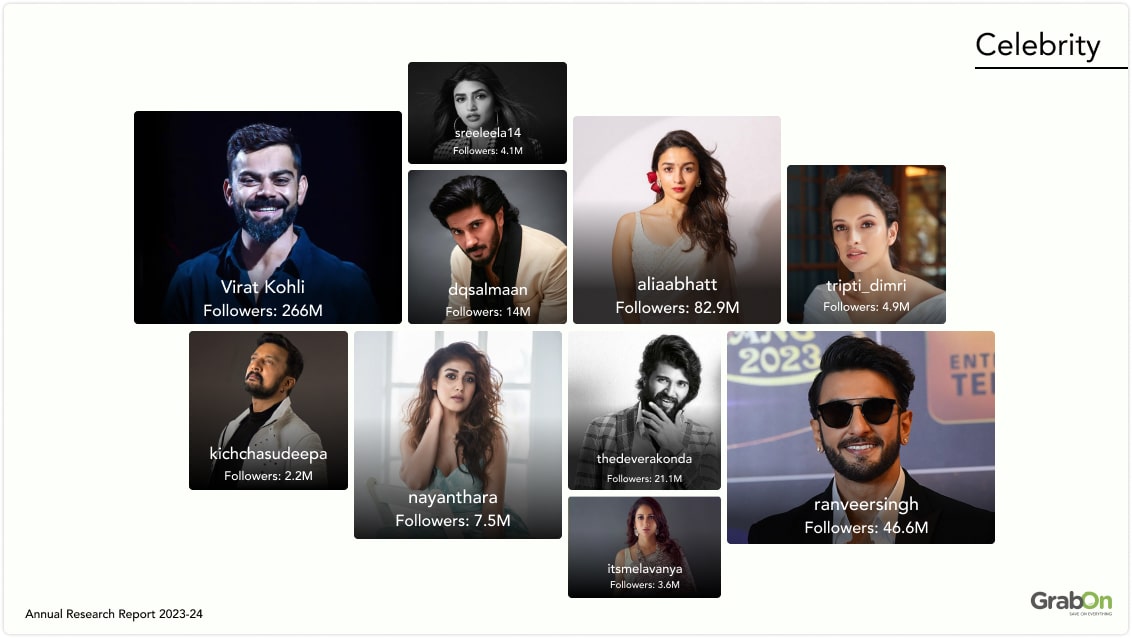

Who Are India’s Top Influencers?

Kofluence has recently released its Annual Research Report for 2023-24 which explores the ever-changing world of influencers in India. The report is accompanied by an infographic that presents important findings, classifying influencers into four categories: Celebrities, Mega, Macro, and Micro. The infographic also highlights the trends and patterns that have shaped the influencer landscape.

Income Earnings Of Indian Influencers

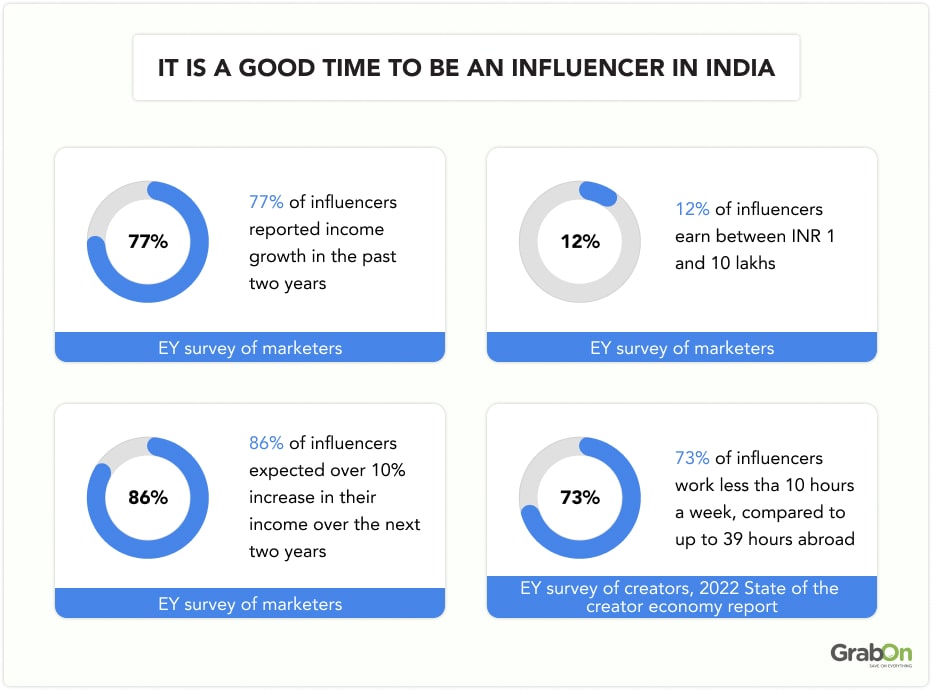

With 86% of influencers in India anticipating a significant increase in their income over the next two years and 77% already experiencing income growth in the past two years, the outlook for influencers in India is promising. Additionally, most influencers work fewer than 10 hours a week, a stark contrast to their counterparts abroad who may work up to 39 hours. Moreover, 12% of influencers in India earn between INR 1 and 10 lakhs, indicating a lucrative earning potential.

Source: E&Y

Additional Stats on Instagram Influencer Marketing

In 2025, Instagram solidifies its position as the leading platform for influencer marketing, with the global Instagram influencer market size projected to surpass $22 billion, outpacing other social networks in brand partnerships and campaign spend. Instagram Stories have become the dominant format, accounting for 71.9% of all brand content on the platform, while Reels and carousels also contribute significantly to high engagement rates. The platform continues to deliver strong returns for brands, generating an average of $4 in sales for every $1 spent on influencer campaigns.

The Path Forward

Influencers in India are increasingly adopting AI tools to create content and looking for ways to optimize their workflows. With 48% of them seeking workflow optimization and 46% actively searching for tools to monitor emerging trends, influencers are striving to produce more impactful content for their audiences. Moreover, half of all brands recognize the effectiveness of influencer content over digital advertising, leading to a shift towards long-term brand partnerships.

This trend not only provides influencers with valuable insight into brands’ values and ethos but also helps brands reach specific audiences more efficiently through niche influencers. As influencer marketing in India progresses into 2025 and beyond, these trends suggest a promising future marked by innovation, authenticity, and meaningful brand partnerships.