Growth in India's eCommerce Market Value (2014-2030)

India’s e-commerce market has grown exponentially thanks to the internet and a shift in consumer behavior. With a population of over 1.4 billion, the country’s diverse mix of cultures and bustling markets has seen a digital revolution that has transformed the way people shop.

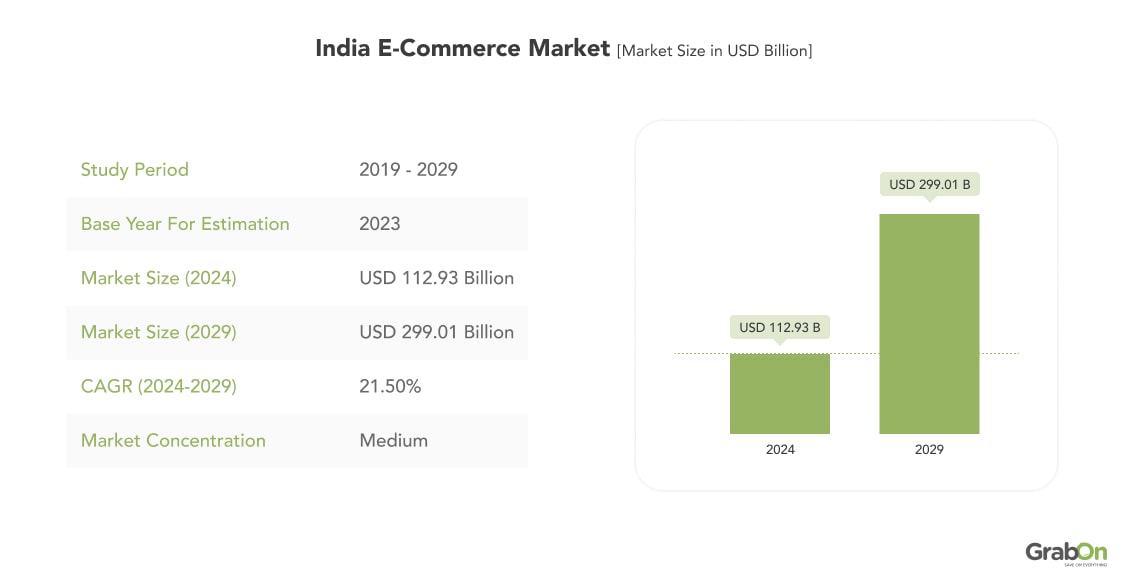

From groceries to electronics, fashion, and home essentials, more consumers are turning to digital platforms for their needs. Currently, the e-commerce market in India is valued at $112.93 billion and is projected to reach $299.01 billion by 2029. This growth highlights the tremendous potential and exciting opportunities for businesses and consumers alike.

This article explores the trends and forces shaping India’s e-commerce landscape.

India E-Commerce Statistics (Editor’s Picks)

- India has witnessed an increase of 125 million online shoppers in the past three years, and it is expected to add another 80 million shoppers by 2025.

- In 2023, India’s e-commerce market size reached $92.7 billion and is expected to reach $200 billion by 2026.

- Mobile commerce (m-commerce) transactions have significantly increased in India due to the widespread adoption of smartphones.

- In FY23, the GMV (Gross Merchandise Value) of e-commerce in India reached $60 billion, up 22% from the previous year.

- Digital payment methods are gaining ground. UPI transactions have become the norm, with over 100 billion total transactions processed through the Unified Payments Interface (UPI) in 2023. Cash-on-delivery (COD) is gradually giving way to digital wallets and cards.

- Flipkart holds 48% of India’s e-commerce market and outpaces industry growth. Meesho, backed by Softbank, is the fastest-growing platform in smaller cities and tier-2 areas.

Source: IBEF, Statista, ECDB, Invest India, Economic Times

E-Commerce Industry Trends in India

The following section highlights some of the latest e-commerce industry trends in India.

Growth of E-Commerce in India

The Indian e-commerce industry has been on an upward trajectory, making it the fastest-growing e-commerce market in the world.

- In FY 2022-23, the Government e-marketplace (GeM) achieved its highest-ever Gross Merchandise Value (GMV) of $2011 billion.

- GeM has facilitated savings worth more than INR 40,000 crore since its inception.

- India boasts over 800 million users, making it the second-largest internet market globally.

- Total UPI transactions crossed the 100 billion mark in 2023, emphasizing the significance of digital payments.

- E-commerce adoption extends to close to 100% of pin codes across the country.

- Tier two cities and smaller towns contribute to more than 60% of transactions and orders.

- Electronics and apparel dominate the e-commerce market, accounting for nearly 70% of transaction value.

- Emerging categories include ed-tech, hyperlocal, and food-tech.

- The ONDC (Open Network for Digital Commerce), launched by the Government of India in 2022, aims to democratize e-commerce and empower MSMEs.

Changing Consumer Behavior in India’s E-Commerce Industry

Consumer behavior has undergone significant shifts, especially due to the pandemic. Here are some insights:

- 80% of consumers expect and desire personalized experiences from retailers.

- Personalization is now a hygiene factor, and getting it wrong can lead customers to switch to competitors.

- Consumers want personalization throughout their interactions with retailers, from offers to communication.

- Unique, one-to-one personalization based on individual preferences is crucial.

Shift Towards Mobile Commerce (m-commerce)

Mobile commerce is a driving force in the retail landscape. Key trends include:

- The global m-commerce market reached $6.3 trillion in 2023 and is projected to grow at a 34% annual rate from 2021 to 2026.

- By 2025, mobile retail commerce is expected to surpass $710 billion.

- Ultra-responsive mobile site design is essential for success, as 74% of people are likely to return to a website if it is optimized for mobile.

- According to a report by GSMA, the number of 5G connections reached 1.6 billion at the end of 2023 and is projected to rise to 5.5 billion by 2030. This is expected to accelerate the shift towards mobile commerce.

Increasing Demand for Personalized Experiences

Personalization is no longer optional—it’s an expectation. Here’s why it matters:

- 71% of consumers expect personalized interactions.

- When done right, personalization can lead to a 1-2% lift in total sales for grocery companies and even higher for other retailers.

- 92% of businesses use AI-driven personalization tactics.

In summary, the Indian e-commerce market is constantly evolving due to changing consumer behavior, mobile commerce, and the demand for personalized experiences. Retailers who adapt to these trends will thrive in this dynamic landscape.

Source: Invest India, Radon Media, Gitnux

Market Size of E-Commerce Industry in India

Market size of the e-commerce industry across India from 2014 to 2018, with forecasts until 2030

India’s e-commerce industry is ripe for growth, thanks to the increasing number of internet users and favorable market conditions. The industry’s market value is growing at an exponential rate and was valued at approximately $22 billion in 2018. But that’s just the beginning. Experts estimate that this number will skyrocket to an impressive $350 billion by 2030. This massive growth potential makes it an exciting time to be part of the Indian e-commerce landscape.

Current Market Size of India’s E-Commerce Industry

The Indian e-commerce industry has witnessed remarkable growth. As of now, the market size is estimated at $112.93 billion. This significant number reflects the growing popularity of e-commerce and the rise in internet usage throughout the country.

Projected Growth of India’s E-Commerce Industry

Looking ahead, the e-commerce sector is poised for further expansion. By 2029, the market is expected to reach $299.01 billion, demonstrating a robust CAGR of 21.5% during the forecast period.

Factors Driving Market Growth of India’s E-Commerce Industry

Several key factors contribute to the burgeoning e-commerce landscape in India:

- The Indian government’s policies, including 100% FDI in B2B E-commerce, are projected to boost the growth of the sector.

- The Digital India initiative aims to transform the country into an online economy worth trillions by 2025.

- A new committee has been formed to review the Open Network for Digital Commerce (ONDC) platform, which the government is supporting to provide infrastructure for online retail.

- The e-commerce sector in India is expected to grow significantly by 2025, with online retail penetration reaching 10.7% and the number of internet buyers reaching 220 million.

- The pandemic-induced lockdown and mobility restrictions drove demand for e-commerce to new heights, bringing new shoppers and sellers into digital platforms and benefiting the industry.

Source: Mordor Intelligence

Key Players in India’s E-Commerce Industry

Market Share Analysis of India’s Biggest E-Commerce Companies

In this section, we analyze the market share of relevant industry players.

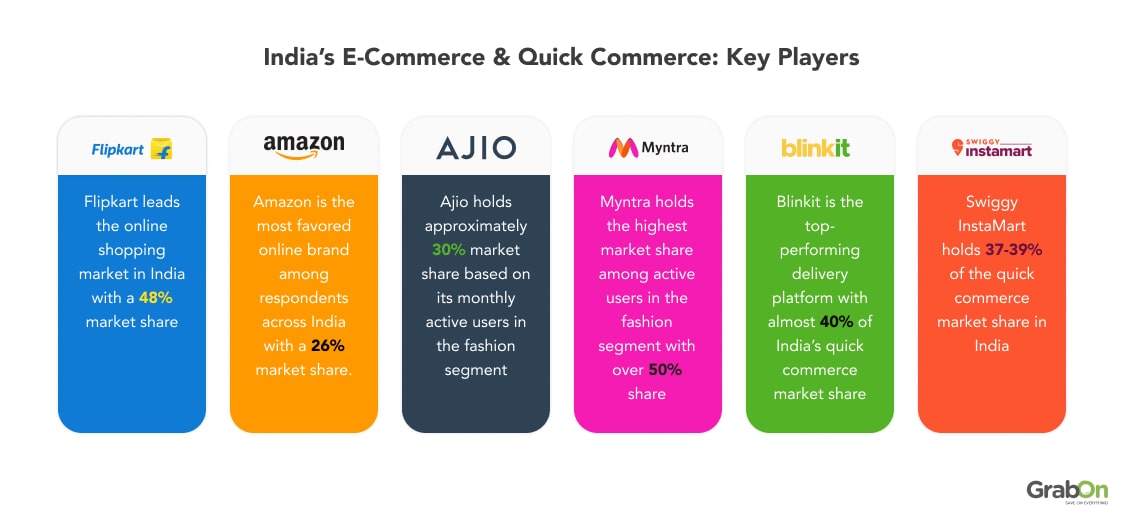

Flipkart leads the online shopping market in India.

Walmart-owned Flipkart has established itself as the leader in India’s e-commerce market, capturing 48% of the market share and surpassing the industry’s growth rate. Meanwhile, Meesho, backed by Softbank, is the fastest-growing platform, especially in tier-2 and smaller cities.

Amazon reportedly leads as the preferred shopping destination.

According to a recent study conducted by Nielsen Media, Amazon has emerged as the most favored online brand among respondents across India. Despite lagging behind in terms of customer growth, the e-commerce giant has managed to retain its position as the top choice for online shoppers in the country, as per the survey results.

Reliance’s Ajio is expanding rapidly in the fashion segment.

Reliance Group-owned Ajio is successfully attracting a large number of users in the fashion industry. Currently, the platform holds approximately 30% market share based on its monthly active users. However, the Flipkart company Myntra still has the highest market share among active users, with over 50% share.

Blinkit is currently the top-performing instant delivery platform.

Blinkit is the fastest-growing e-grocery player due to market maturity, while Zepto lags behind in product offerings and reach since it began operations in April 2021.

According to an analysis by AllianceBernstein, the quick commerce market in India is led by three players, with Blinkit holding almost 40% of the share, InstaMart holding 37-39%, and Zepto holding around 20% from a GMV perspective.

Competitive Landscape

Intense Competition: Amazon and Flipkart engage in fierce competition, driving innovation and attracting investments.

Emerging Players: Reliance, Tata, Nykaa, and other players are joining the race.

As the competition heats up, companies are focusing on improving their logistics network, increasing product offerings, and enhancing the overall customer experience. This has led to a highly competitive market, with all players vying for a larger share of the e-commerce pie.

Source: TOI

Popular Categories in India’s E-Commerce Industry

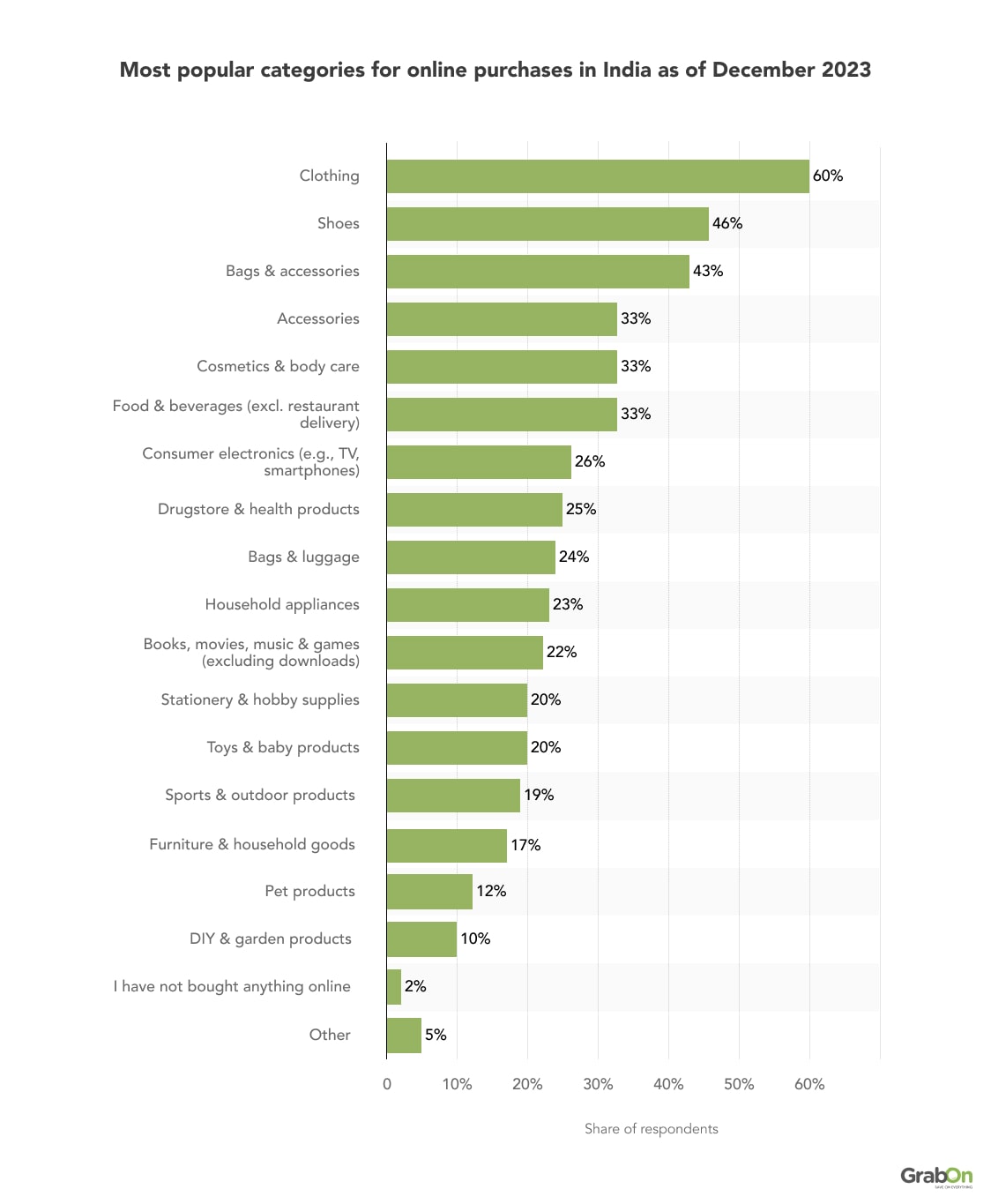

According to a recent study, Indian consumers are increasingly shopping online, with clothing and footwear being the most popular categories. This trend of online shopping gaining traction among consumers is not surprising, considering the convenience and advantages it offers.

E-commerce platforms provide wider product choices, better deals, and doorstep delivery, which saves time and effort. In addition, the ease of returning products and the availability of secure payment options have made online shopping more trustworthy and reliable.

Source: Statista

Popular Payment Methods in India’s E-Commerce Industry

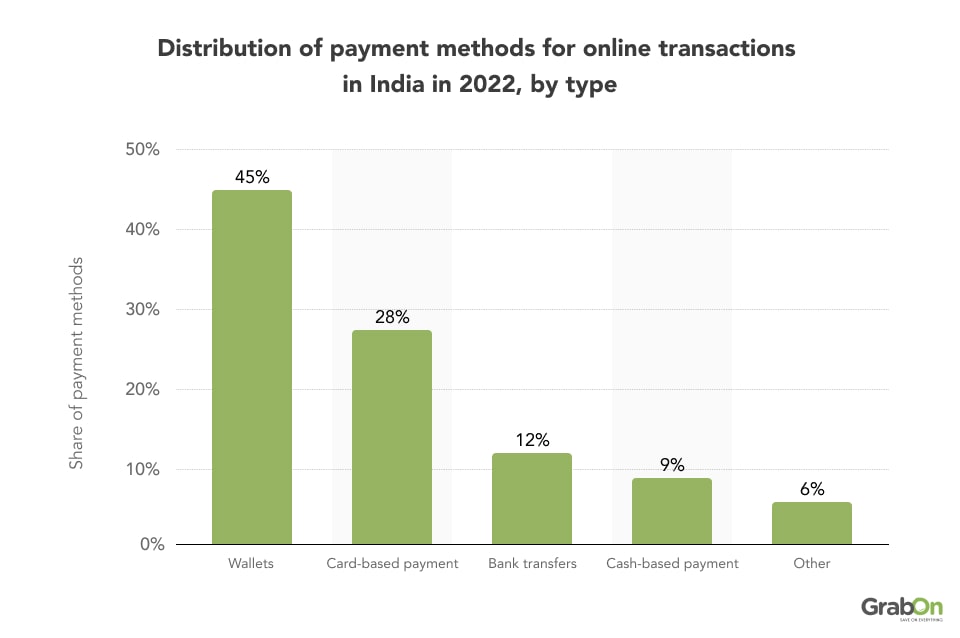

- Wallets: Wallets were the dominant payment method for e-commerce transactions in India in 2022, accounting for a substantial 45% share. These digital wallets facilitate convenient and secure online payments.

- Credit and Debit Cards: Credit and debit cards followed closely, with a 28% share. Due to their ease of use and widespread acceptance, these cards are widely used for online shopping.

- Net Banking: Net banking, which allows users to make payments directly from their bank accounts, constituted 12% of the total. It remains a reliable option for many Indian consumers.

- Cash-Based Payment: Surprisingly, cash-based payment still held a 9% share for online shopping. Despite the digital revolution, some consumers in India continue to prefer cash transactions.

- UPI: As of January 2024, the Bharat Interface for Money (BHIM) Unified Payments Interface (UPI) was the top digital payment mode in India, with around 81 billion transactions in sectors like online retail, food delivery, mobility, and e-health in FY 2023.

Source: Statista

Wrapping Up

The Indian e-commerce industry has seen tremendous growth and shows no signs of slowing down. With a projected market size of $350 billion by 2030 and an expected addition of another 80 million online shoppers by 2025, the industry is poised for continued success. As consumer behavior continues to evolve, the demand for personalized experiences and mobile commerce is increasing.

Retailers who can adapt to these trends and provide a seamless shopping experience will thrive in this dynamic landscape. With the government’s ONDC initiative to democratize e-commerce and empower MSMEs, the future looks bright for the Indian e-commerce industry.