Save Up to 97% on Best-Selling Courses!! JOIN NOW

Save Up to 97% on Best-Selling Courses!! JOIN NOW

Save Up to 97% on Best-Selling Courses!! JOIN NOW

Save Up to 97% on Best-Selling Courses!! JOIN NOW

GST is the one word that is everywhere these days, from newspapers to web news portals, news channels and social media platforms. Do you find yourself lost when people start talking about GST?

Do you genuinely want to learn what the fuss is all about? Well, we've got just what you need: The A to Z guide about GST for dummies! Learn all about GST and find how it would impact you.

Worry not, this is going to be very easy and simple without throwing in any technical jargons!

First, we need to discuss what taxes are and how the current taxation system of India works.

Taxes are an involuntary fee that is levied or imposed on a person or an organization by the government. These taxes can be levied by local, regional or national government entities. The taxes imposed are used to fund government activities like public works or services, boost the country's economy and to improve the living standards of the citizens. The constitution of India grants power to the central and the state governments to levy taxes on the general population. However, all of the taxes imposed must be supported by a law passed by the parliament or state legislature.

Moving onto the types of taxes levied or imposed. Taxes can be broadly classified into two categories:

Apart from these two broad classifications, there are other types of taxes like the Cess tax that is imposed by the central government like the Swachh Bharat Cess tax. We'll cover these later, but for the time being we'll discuss about Direct and Indirect Tax in detail.

The classification is made based on the difference in application and implementation of the taxes.

Direct Tax: Direct Tax as the name suggests is the tax amount that is paid by you directly to the government and can't be transferred to any individual or enterprise. In India the government body that oversees the payment of direct taxes is called Central Board of Direct Taxes (CBDT) . The CBDT is a part of the Department of Revenue and helps in smoothly carrying out its duties. The CBDT also helps in upholding various tax acts that dictate how direct taxes are to be levied.

Let's have a look at some of the tax acts that keeps the direct tax imposition in check:

Also know as the IT Act of 1961. This act basically sets up all the rules on income taxation in India. This act taxes the income from sources like business, investments, house or properties that you own, salaries etc. Have you ever opted for a life insurance premium or fixed deposit? Well, this is the act that dictates the tax benefit on those. This act also decides how much you can save through investments and the income tax slabs.

This 1958 act would impose a 30% tax on any gifts or monetary value items such as property, jewellery, shares etc. gifted to an individual. This act was eventually abolished in 1998, thus exempting taxes on gifts received by an individual from family members and local or regional organizations. However if anyone or any organization other than the ones exempted gift you something that exceeds Rs 50,000, the whole gift amount is taxed.

This act passed in 1951 determines the amount of tax imposed on the net wealth of an individual or an organization. The calculation for this tax was as follows: If the net worth of the individual/organization exceeded Rs 30 Lakhs then 1% of that amount was to be paid as tax. However, the budget announcement of 2015 abolished this act. Since then it has been replaced by a surcharge of 12% on individuals with per annum earnings of more than 1 Crore. It is also applicable on organizations with revenue more than 10 Crores per annum.

This act of 1974 dealt with the tax payable on interest but has been since amended, not to apply on interest earned after March 2000.

This 1987 act imposes taxes on the services that an individual enjoys at a hotel or a restaurant. It is applicable in all Indian states except Jammu and Kashmir. The expenses are subject to tax if the amount exceeds Rs 3,000.

Now, let's take a look at some of the examples of Direct Taxes:

One of the most dreaded taxes, this is levied on your annual earnings during the financial year. This tax is applicable to both individuals and organizations. The amount to money to be deducted in tax depends upon a variety of factors like tax slabs, taxable income and its reduction, tax deduction at source (TDS) and much more. The Government of India has differentiated the tax slabs into general taxpayers, senior citizens and super senior citizens. Based on these slabs you are liable to pay anywhere from 0 to 30% tax depending on which slab you fall under. Here we'll have a detailed and simplified look at the tax slabs and their classification.

Income Tax Slab Rates for FY 2017-18 (AY 2018-19)*HUF: It is defined under the Hindu Law as a family that consists of all persons lineally descended from a common ancestor, including wives and unmarried daughters. Income from HUF can be profits from business, income from house or property, capital gains or income from other sources.

| Income Tax Slab | Income Tax Rate |

|---|---|

| Income up to Rs. 2,50,000* | No Tax |

| Income from Rs. 2,50,000 – Rs. 5,00,000 | 5% |

| Income from Rs. 5,00,000 – 10,00,000 | 20% |

| Income more than Rs. 10,00,000 | 30% |

| Surcharge: 10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. 15% of income tax, where total income exceeds Rs. 1 crore. | |

| Cess: 3% on total of income tax + surcharge. | |

| * Income upto Rs. 2,50,000 is exempt from tax if you are less than 60 years old. | |

| Income Tax Slab | Income Tax Rate |

|---|---|

| Income up to Rs. 2,50,000* | No Tax |

| Income from Rs. 2,50,000 – Rs. 5,00,000 | 5% |

| Income from Rs. 5,00,000 – 10,00,000 | 20% |

| Income more than Rs. 10,00,000 | 30% |

| Surcharge: 10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. 15% of income tax, where total income exceeds Rs. 1 crore. | |

| Cess: 3% on total of income tax + surcharge. | |

| * Income upto Rs. 2,50,000 is exempt from tax if you are less than 60 years old. | |

| Income Tax Slab | Income Tax Rate |

|---|---|

| Income up to Rs. 2,50,000* | No Tax |

| Income from up to Rs. 5,00,000 | No Tax |

| Income from Rs. 5,00,000 – 10,00,000 | 20% |

| Income more than Rs. 10,00,000 | 30% |

| Surcharge: 10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. 15% of income tax, where total income exceeds Rs. 1 crore. | |

| Cess: 3% on total of income tax + surcharge. | |

| * Income upto Rs. 2,50,000 is exempt from tax if you are less than 60 years old. | |

This tax is payable when you receive a fairly large amount of money from an investment or through a property sale, whatever be it. The capital gains are of two types:

The tax imposed on Short Term Capital Gains is calculated based on the income tax slab/bracket you fall under and the tax collected on Long Term Capital Gains comes to about 20%. In cases where the gain is in the form of kind instead of monetary value, the tax will be levied on the amount of exchange in kind.

If you have ever traded in shares or securities on the share market, then you're aware that if traded properly quite a good amount of money can be made. As such the tax applicable on these securities are added to the price of the share. This means every time you buy a share, on the Indian Stock Exchange you're also paying the tax on it.

This is the tax levied on privileges you as an employee enjoy from your employer. These include major privileges like car or vehicle provided for daily commute or minor ones like payment of telephone bills. The tax is imposed considering how the perquisite is acquired by the employer or how the employee uses it. For eg: If the office vehicle is used for both official and personal reason could be taxed but if it's only used for official purposes, no taxes are levied on it.

This is the income tax levied on the revenue earned by a company. It has it's own slab depending upon which the tax is deducted. For eg. a company with annual revenues under Rs 1 Crore won't have to pay this tax, while companies with revenue. It also goes by the name 'surcharge' and differ according to the revenue slabs. The international companies have different tax rates compared to the domestic companies, like the international companies have to pay corporate tax of 41.2% in case the revenue generated is less than rs 10 million.

The corporate tax is further divided into 4 categories:

Indirect Tax: This is the type of tax that is imposed on goods that you buy or services that you enjoy. As the name suggests these taxes aren't directly payable to the Government by the consumer i.e. you. They are collected and paid to the government by the Middle man i.e. the person who provides the service or sells the product. These taxes are added to the price of the product thus making it costlier. Some of the most common examples of indirect taxes are Value Added Tax (VAT) and Sales Tax.

Let's have a look at some of the other examples of Indirect Taxes:

Sales Tax: This is the tax that is levied or imposed on the sale of the product. The tax is imposed on the product seller who transfers it to the end consumer. The sales tax is included in the price of the item sold. However there is one major problem with this tax: it can be applied only once. That is if the product is sold for a second time, Sales Tax can't be levied on it. The Sales Tax Act differs according to the state and the Sales Tax Act the particular state follows. On top of the Sales Tax that is charged, several other taxes like turnover tax and purchase tax are also levied by the state governments thus making Sales Tax one of the highest revenue generators. The Sales Tax is imposed under the state as well as central legislations.

Service Tax: Just like Sales Tax is added to the selling price of goods, Service Tax amount is added to the services provided. In budget reading of 2015, it was announced that the tax rate would be raised from 12.36% to 14%. The Service Tax is applicable only to companies that provide services. It is collected on a monthly or quarterly basis depending upon how the service is provided. If the service provider is an individual then the Service Tax amount is to be paid when the customer pays the bill. However, if the service provider is a company then the tax is payable at the very moment the invoice is filed and doesn't depend on when the customer pays the bill. Service Tax levied at restaurants is kept at a rate of 40% of the total bill amount.

Value Added Tax: This tax is levied or imposed throughout all the stages of the supply chain viz. the manufacturer, the distributor, wholesaler, retailer all the way to the consumer. However, it is not applicable on food items, essential drugs or exported items. Just like Sales Tax, the Value Added Tax or VAT is decided by the state for eg. The Gujarat State Government has divided the goods into 3 categories and split the tax rate as 1%, 5% and 15 % respectively.

Custom Duty &Octroi: Custom Duty is the tax levied on goods that need to be imported from another country by land, sea and or air. It doesn't matter if you purchase the said item in a different country and then bring it to India. The taxes will still be imposed. While the Custom Duty makes sure that the products entering India are properly taxed, similarly the Octroi makes sure that goods leaving the state borders are appropriately taxed. The Octroi charges are maintained by the state government.

Excise Duty: This is the tax that is levied on all goods that are manufactured in India, unlike the Custom Duty taxes imposed on goods made in foreign countries entering India. It is also called the Central Value Added Tax or CENVAT. The tax is collected by the government from the manufacturers or from those who receive and consequently distribute the manufactured goods. According to the Central Excise Rule passed by the Central Government, the tax has to be paid on the excisable goods before it can be moved, say from a manufacturer or from a distributor who has stored it in a warehouse.

Other Taxes: Apart from the direct and indirect taxes, there are quite few other types of taxes for eg. Cess, the fund or the amount after taxation generated, which is used for various purposes decided by the finance minister of the country. While these taxes aren't major revenue generators like the Sales Tax, but they help the government in carrying forward initiatives that raise the standard of living of the citizens.

Let's have a look at some of these taxes:

Professional Tax - This tax is levied by the state governments on professionals or employees, hence also called Employment Tax. The amount to be taxed is decided by the state government and whether to levy this tax or not is totally up to the state government.

Property Tax - This tax is imposed by the local municipal authorities of your city, hence also referred to as Municipal Tax or Real Estate Tax. This amount raised through this tax is used to improve the civic amenities of the city you reside in.

Entertainment Tax - This is one of the most commonly levied taxes on India. As the name suggests, this tax is imposed on movies, exhibitions, amusement parks etc. The amount to be taxed is decided based upon the gross collection, box office earnings for movies or audience participation in case of exhibitions.

Stamp Duty, Registration Fee and Transfer Tax - These are the taxes that come along with the Property Tax. While buying a property you would need to pay for the stamps, the fees charged by a registrar to legalize a property transaction and the tax levied on transference of ownership of an item.

Education Cess/Surcharge: This tax goes into the educational programs that are run and sponsored by the Government of India. Everyone starting from an individual to an organization and people residing in the country has to pay for this cess. The current tax rate for Education Cess is 2% of an individual's income.

Toll Tax/Road Tax - This is the tax that you pay while making use of an infrastructure that is built by the government for eg. roads, bridges, tunnels etc. The minimal amount of tax that is collected from you is utilized in maintenance and repair of the said infrastructure.

Swachh Bharat Cess - You must have heard about this cess tax. It was started in November 2015 and the current rate is 0.5% of taxable services. It is slapped on top of the already existing 14% Service Tax. This cess is not applicable on items that are exempt from paying the service tax. This cess is not covered under Service Tax and is mentioned separately in a bill or invoice. This cess is collected by the Consolidate Fund of India and goes into any Swachh Bharat Abhiyan activities.

Krishi Kalyan Cess - Operational since June 2016, this cess is brought into effect to facilitate better agricultural techniques to the farmers of our country. Just like Swachh Bharat Cess this is levied at 0.5% of all taxable services. It is mentioned separately in the invoice and is independent of the Sales Tax and the Swachh Bharat Cess.

Infrastructure Cess - This tax brought into being on 1st June 2016, speaks about the cess levied on motor vehicles depending upon the length and engine capacity of the car.

Entry Tax - This type of tax is levied when an item ordered by an e-commerce portal enters few select states of India like Delhi, Assam, Madhya Pradesh, Gujarat etc. The tax rate stands in between 5.5% - 10%.

GST or Goods and Service Tax is the comprehensive tax that is brought into effect in order to replace all the other indirect taxes (mentioned above) imposed by the state and central government. It is levied on manufacture, sale and use of the goods and services. The amount collected after levying GST will be used to propel the economic growth of the country.

Goods and Service Tax is imposed by the government as a sort of Value Added Tax on the goods you buy or services that you enjoy. The tax collected by the businesses (an individual or an organization) is handed over to the government imposing the tax. The amount varies from country to country.

As of now, there are umpteen indirect taxes in India, the Goods and Service Tax, aims to bring all of the indirect taxes under one category. The GST Bill was introduced in the lOk Sabha as the Constitution (122nd amendment) Bill 2014, by Finance Minister Arun Jaitley on 19th December 2014. The parliament passed the bill on 6th May 2015 with a 352 votes 'for' and 37 votes 'against'. Rajya Sabha passed the bill on 3 August 2016, and Lok Sabha passed the amended bill on 8 August 2016. The GST is touted to push India up in World Bank rankings for 'ease of doing business' index and boost economic growth by reducing corruption &removing the contradictory tax policies between state and centre. GST will merge the state and central taxation process thus bringing down double taxation and making way for a common market for the entire country.

Taxation System In Practice:Currently, the taxes imposed by the state include Sales Tax, Value Added Tax, Octroi, Stamp Duty, Entertainment Tax, Toll Tax etc. The Central government levies Customs Duty, Income Tax, Excise Duty, Central Sales Tax while the Property Tax is imposed by local authorities. Given the current taxation system in place, the states have the right to levy their own tax on the sale and use of goods crossing into their border. The centre however imposes tax on manufacture of these goods.

For example, a heavy machinery manufacturer in Odisha has to pay an excise duty or Central VAT to the government of Odisha, during the manufacturing process. Getting a supply of parts from Jharkhand would result in paying state taxes applicable in Jharkhand and also the import tax on bringing the parts into Odisha. If the furnishing material is brought in from Bihar, that would mean another set of state taxes to Bihar government and import taxes to the Odisha government. So, by the time the manufactured machinery reaches the market, the price goes up by a huge margin due to multiple taxations (also called Tax Cascading ) on the product. This is where the current taxation system fails! Only the CENVAT and the Service Tax paid during manufacturing can be reclaimed but not the other taxes.

How GST India Will Work:GST, once implemented will club all of these separate State and Central taxes into Central GST and State GST, thus erasing the borders between states and making India a common market place. This will enable the manufacturer or the trader to claim the taxes paid while adding value during the manufacturing, distributing, and retailing process. This in turn will reduce the tax burden on the end consumer i.e. you. You will have to pay only the tax charged by the last dealer in the chain of supply. GST removes multiple taxations and brings a greater transparency in the payment process of taxes to the government. However the downside is the GST tax rates in India, might actually be higher than the current rates for some goods and services.

The tax applicable on products being imported and exported across the states will be taken care of by Integrated GST (IGST) to avoid messing up Central GST (CGST) and State GST (SGST).

This will give you a better idea about the pros and cons of GST:

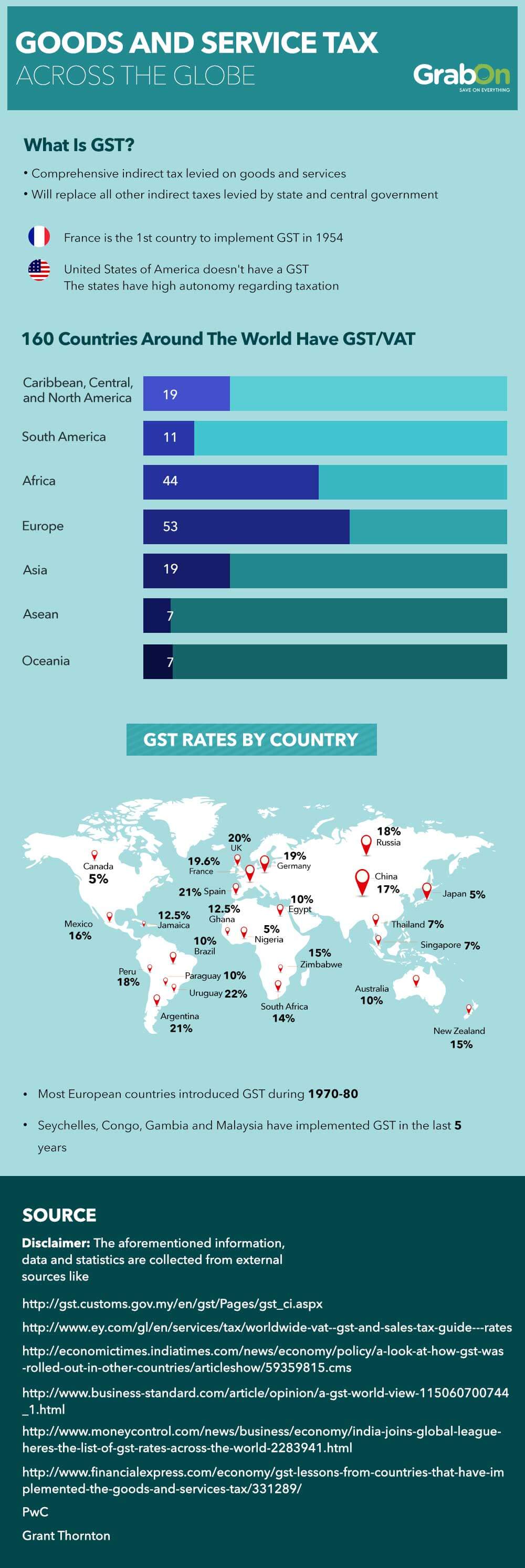

Adavantages:About 160 countries in the world already have a unified GST or VAT in place. France kickstarted this back in 1954. Almost all of the European countries have GST. USA happens to be one of the world powers without a GST, as it provides a high level of autonomy to the states when it comes to taxation.

Let's have a look at the different countries their GST tax rates and how they differ from GST tax rates in India:

| Asean Countries | |

| Country | GST/VAT Tax Rate |

| Indonesia | 10% |

| Philippines | 12% |

| Cambodia | 10% |

| Vietnam | 10% |

| Laos | 10% |

| Asian Countries | |

| Country | GST/VAT Tax Rate |

| Bangladesh | 15% |

| Srilanka | 12% |

| Pakistan | 16% |

| Taiwan | 5% |

| South Korea | 10% |

| Thailand | 7% |

| Singapore | 7% |

| China | 17% |

| Japan | 5% |

| European Countries | |

| Country | GST/VAT Tax Rate |

| Austria | 20% |

| Belgium | 21% |

| Hungary | 27% |

| Finland | 24% |

| France | 19.6% |

| Germany | 19% |

| Russia | 18% |

| Spain | 21% |

| UK | 20% |

| Ireland | 23% |

| Netherlands | 21% |

| Norway | 25% |

| Poland | 23% |

| Portugal | 23% |

| Switzerland | 8% |

| Oceania | |

| Country | GST/VAT Tax Rate |

| Austria | 10% |

| New Zealand | 15% |

| Fiji | 15% |

| Samoa | 15% |

| African Countries | |

| Country | GST/VAT Tax Rate |

| Algeria | 17% |

| Botswana | 12% |

| Central African Republic | 19% |

| Chad | 18% |

| Democratic Republic of Congo | 16% |

| Ethiopia | 15% |

| Egypt | 10% |

| Ghana | 12.5% |

| Ivory Coast | 18% |

| Kenya | 10% |

| Madagascar | 16% |

| Madagascar | 20% |

| Malawi | 16.5% |

| Mauritius | 15% |

| Morocco | 20% |

| South Africa | 14% |

| Uganda | 18% |

| Zimbabwe | 15% |

| South American Countries | |

| Country | GST/VAT Tax Rate |

| Argentina | 21% |

| Brazil | 10% |

| Colombia | 16% |

| Chile | 19% |

| Ecuador | 12% |

| Paraguay | 10% |

| Peru | 18% |

| Uruguay | 22% |

| Caribbean, Central, And North American Countries | |

| Country | GST/VAT Tax Rate |

| Barbados | 17.5% |

| Canada | 5% |

| Costa Rica | 13% |

| El Salvador | 13% |

| Honduras | 12% |

| Jamaica | 12.5% |

| Mexico | 16% |

| Panama | 7% |

| Trinidad and Tobago | 15% |

Here are some of the most commonly used words and phrases when referring to the Goods and Service Tax. It’s high time you adapt to the lingo and these words will amp up your street cred!

The other half of this transaction is SGST or State Goods and Service Tax.

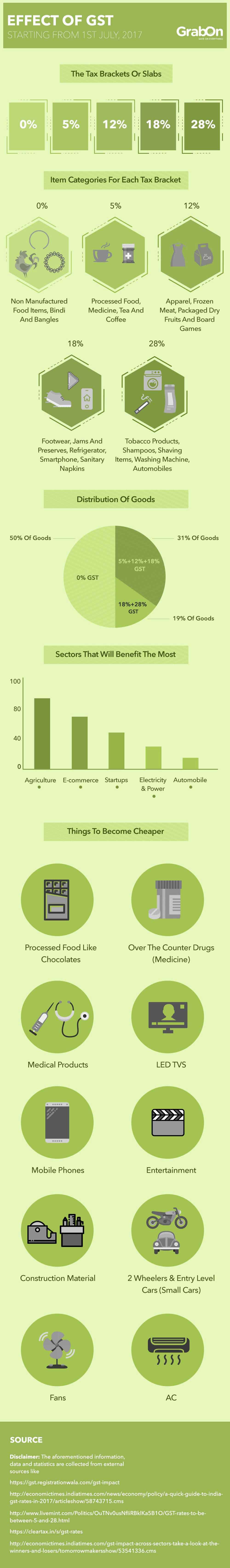

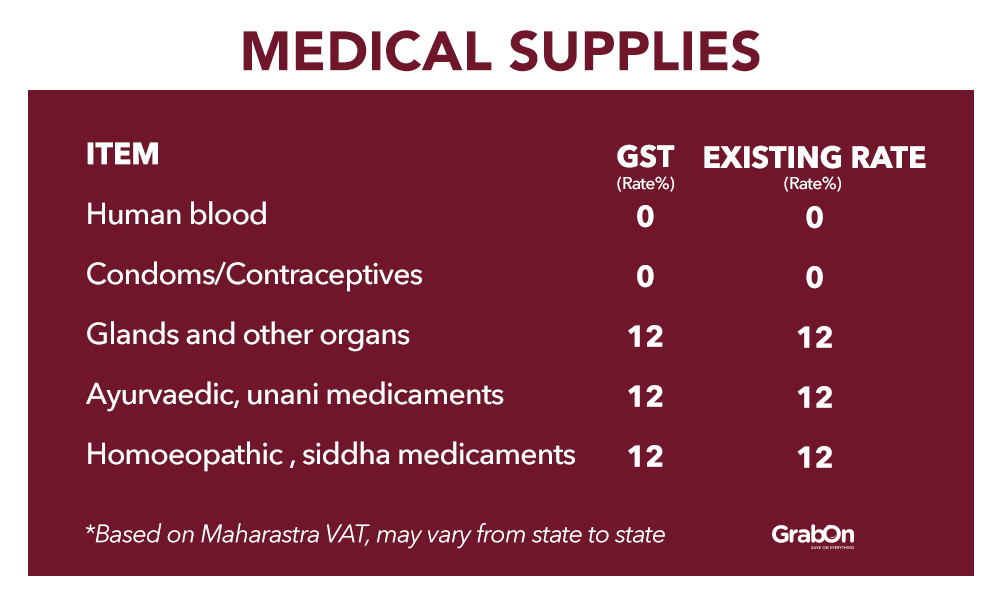

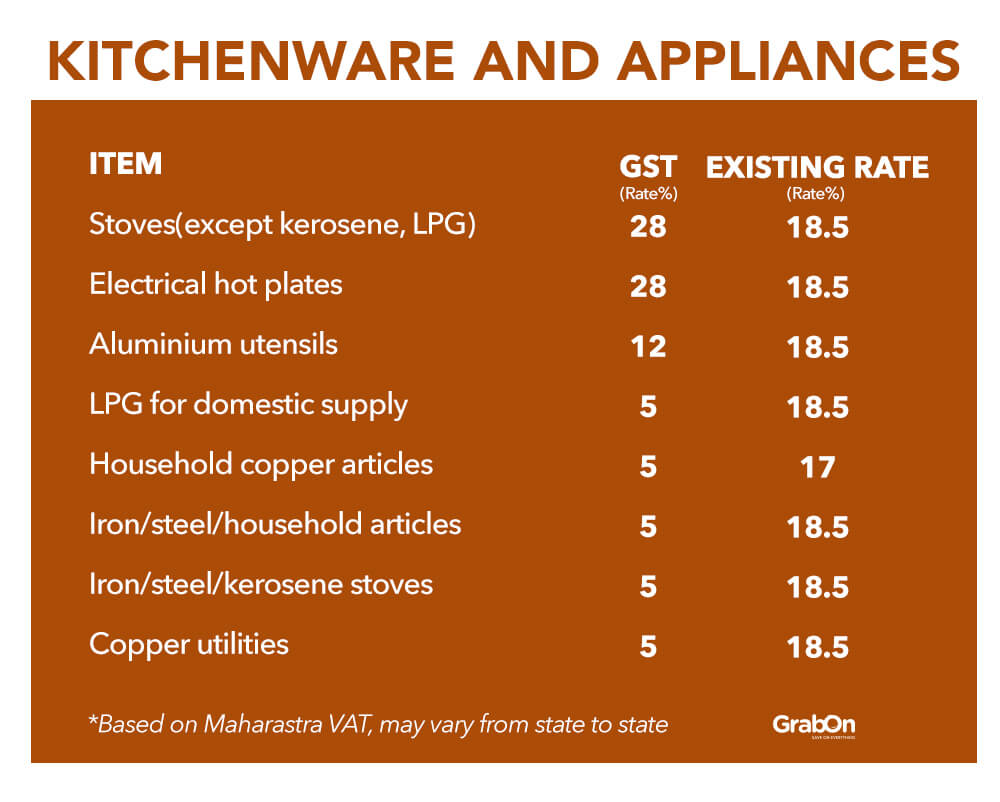

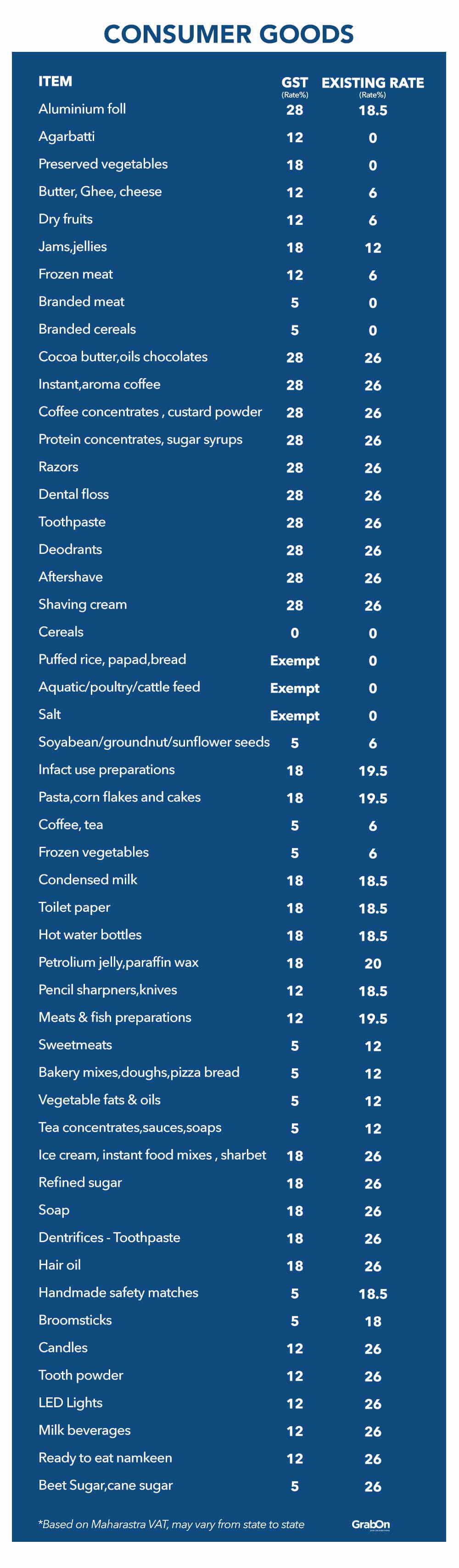

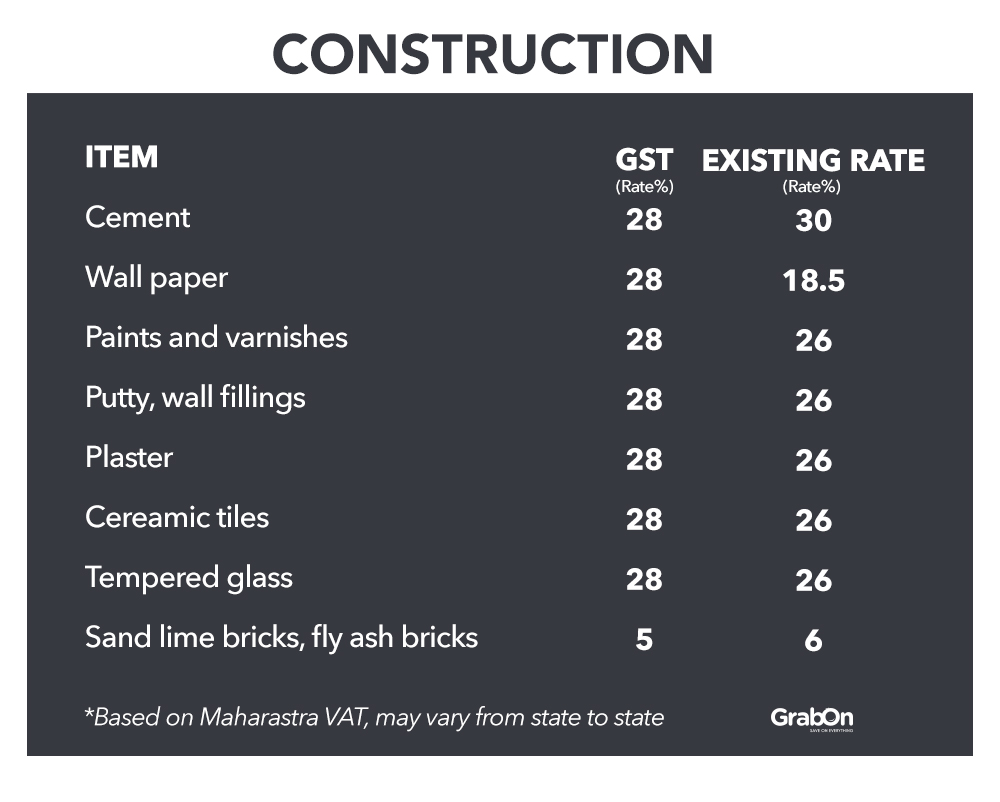

In simple terms, GST is one indirect tax where the whole nation has to pay. This single tax is applied on the supply of goods and services right from the manufacturer to the consumer. When GST rates were announced there was a lot of curiosity among the people regarding which products fall under which GST slabs. As we all know the GST has four different slab rates at 5%, 12%, 18% and 28%, let us have a look at the GST tax structure and the categories falling under each slab. Apart from the regular 4 slabs, there are exemptions for gold and rough diamonds which will be taxed at 3% and 0.25% respectively.

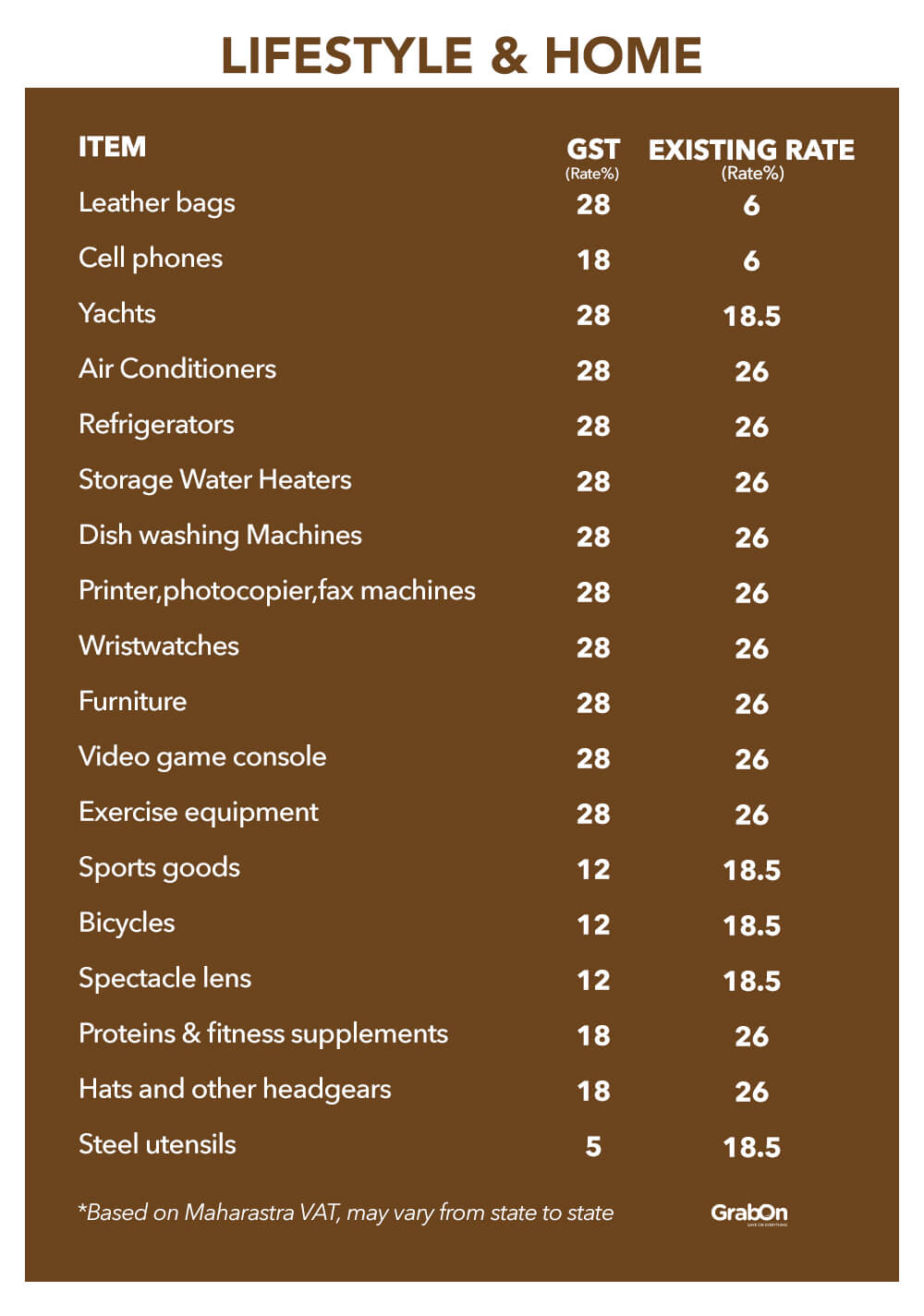

When it comes to the four rate slabs which are available, there is a separate rate slab for luxury goods like high-end cars, tobacco, aerated drinks and pan masala. There is a tax of 40-65% on these items which is making them unavailable to common man. One good news for a common man is that food grains are going to be taxed at zero rates, a good sign for improvement. Where the most commonly used white goods like washing machines, ACs, shampoo, refrigerators are going to be taxed at 28%. As per the recent statistics, there are over 1211 goods and services falls under the GST rate slabs. Here are the stats and the percentage of the goods and services.

However, GST is the combination of taxes at the central and state level. The central level of taxes includes central excise duty, additional excise duty, service tax, countervailing duty, and special additional duty of customs. The state level of taxes include state value added tax, entertainment tax, entry tax, purchase tax, and luxury tax. One main objective of GST is to eliminate all the double taxation which was applied before. The GST tax structure will have two components which include the tax that is levied by the center (referred as CGST) and the other tax which is levied by the states (SGST). CGST and SGST will be applicable to all transactions of goods and services which are made for consideration except the exempted goods and services.

By following the GST transparency system, there are quite a lot of benefits that include:

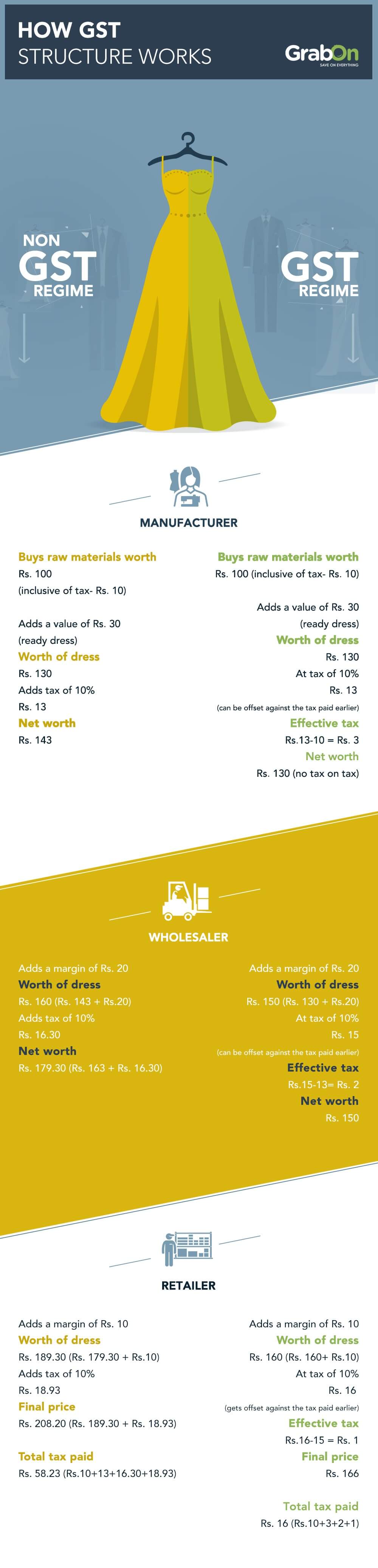

Apart from the above-stated rates, there will also be a considerable change in the prices of products. Let’s take an example which shows the tax structure before GST. Consider an apparel where the manufacturer buys the raw material worth of Rs.100 which is inclusive of Rs.10 as taxes. Now, the manufacturer will add a value of Rs.30 to the made apparel and the gross value will become Rs.130, and a tax of 10% i.e. Rs.13 will be applied which sums up to Rs.143 (Rs.130 + Rs.13) and it will be sold to a wholesaler. The wholesaler will add a margin of Rs.20 and the dress will costs now at Rs. 163 (Rs.143 + Rs.20) and adds a tax of 10% (Rs.16.30) and dress costs at Rs. 179.30 (Rs.163 + Rs.16.30). Now it's the turn of the retailer to buy this dress and adds Rs. 10 as his margin, where the cost will increase to Rs.189.30 with an additional tax of 10% i.e. Rs. 18.93 and costs around Rs. 208.23 (Rs. 189.30 + Rs. 18.93). the total tax paid on one single apparel is about Rs.58.23 that includes the tax of Rs.10+13+16.30+18.93.

Now, here comes the cost of the apparel after the GST is applied. Consider an apparel where the manufacturer buys the raw material worth of Rs.100 which is inclusive of Rs.10 as taxes. Now, the manufacturer will add a value of Rs.30 to the made apparel and the gross value will become Rs.130, considering the tax rate 10% has to be applied but this 10% I.e Rs.13 can be offset against the tax paid on raw materials so, the effective tax will be Rs. 3 (Rs.13-Rs.10). Now, the dress will be sold to the wholesaler at Rs. 130 as there is no tax on the tax. The wholesaler will add his margin of Rs. 20 and the effective cost will be Rs.150 (Rs.130 + Rs. 20). and the tax of 10% would be applied which is of Rs.15. This Rs.15 as tax will be offset against Rs. 13 tax that is paid earlier and the wholesaler will need to pay Rs.2 (Rs. 15-Rs.13). The retailer now buys the dress at Rs. 150 and adds a margin of Rs.10 and the cost will increase to Rs.160. On this, the tax of 10% applies where it will offset on previous tax of Rs.15 that is paid earlier. The tax incident will be Rs.1 (Rs.16-Rs.15). Here comes the total price of the apparel- Rs.166, where the tax paid is Rs. 16 (Rs.10+3+2+1).

After a long wait, the Indian government is here with all new and updated GST laws. By registering GST there are chances to eliminate the cascading effects of other taxes. As the prices of goods and services will fall, and there will be a steady flow of input tax credit. This GST will make every sector into an organized sector by eliminating the loopholes which are present earlier.

Before you start GST registration, let’s know why it is important to get GST registration? The answer is simple, it will enable to avail various benefits which are under GST regime. The main benefit is to get seamless input tax credit. The multiple taxes which were present earlier are waved off and now there is no more confusion regarding the taxes what we are paying. So, the confusion about various taxes are cleared by one single tax- GST. There are over 8 million taxpayers and everyone will be allotted with the GSTIN (Goods and Services Tax Identification Number). And this number is an unique number which will be useful for further references. There will also be penalties charged by government for not registering under GST. The penalty will be charged at 10% of the tax due and it may go as high as 100% if it is proved as deliberate fraud.

As we all know that GST registration is important and before you apply go through the list which is given below to know who can register GST.

If a person is holding various /multiple businesses in a particular state, then he needs to register for each business separately. For example, if he hold 10 businesses, then he is supposed to do 10 GST registration. For every single registration , he needs to submit PAN.

Migration To GSTTaxpayers who were earlier registered with central excise, service tax assessees and VAT will be migrated to GST. All the migrants will be provided with a provisional ID card and password by CBEC/State Commercial Tax Departments. Also the provisional ID will be provided to the people who have a valid PAN associated with their registration. There are also few exemptions that provisional ID would not be allotted, like:

The government of India has set a particular limit for the taxpayers (person or entity) with respect to their total aggregate turnover. The person or the entities who fall under this particular criteria are exempted from not registering GST. There are other few exemptions for the eligibility criteria that include the taxpayers whose turnover of less than Rs. 20lacs is exempted from tax. This aggregate turnover includes the total value of all the non-GST/non-taxable supplies, nil-rated supplies, and good/services.

Exemption Under GST RegistrationThere are few exemptions under GST registration which are stated by the government of India. Few of the tax payers are exempted based on the nature of the business.

The government has given an exemption for the small businesses and the taxpayers who are having a turnover of fewer than Rs.75 lacs. These businesses can opt for the composition scheme where they will be taxed at a very nominal rate of maximum 2.5%. all they have to do is file the quarterly returns instead of the monthly returns. And they cannot collect the tax from the customers in the form of taxable invoices. Persons who are engaged in the supply of services, people who supply goods which are not leviable to tax under this GST, people who make the supply of goods through any e-commerce operator, and persons who are a manufacturer of any such goods are not eligible to claim the composition scheme.

How To Register- New And Old UsersNote: GST registration date is extended and will re-open on 25th June 2017 and will continue for 3 months.

Documents Required:As GST is going to be implemented from 1st of July, 2017 there has to be registration done beforehand to avoid the inconvenience. The person or the entity who are eligible are required to register GST along with few documents which are mandatory. For person ID proof, they can submit PAN, driving license, passport, aadhaar card or voter ID card. And for the address proof, documents like passport, aadhaar card, voter ID card, ration card or driving license can be submitted.

For Companies:For company or business registration, the proof of business registration is mandatory for any type of entity. Apart from this, there are other documents which have to be submitted.

In the case of LLP/partnership, the incorporation certificate from MCA (Ministry Of Corporate Affairs) is mandatory. Apart from the stated certificate, there are other documents which has to be submitted.

The persons who can apply for the GST on behalf of their property are proprietor, managing/designated partners, karta, managing trustee, CEO or any person who is in charge.

When it comes to the GST rules, there are various categories under the rules. These include the Composition Rules, Valuation Rules, Transition Rules, ITC Rules, Invoice Rules, Payment Rules, Refund Rules, Registration Rules and Return Rules. The major rules are explained below:

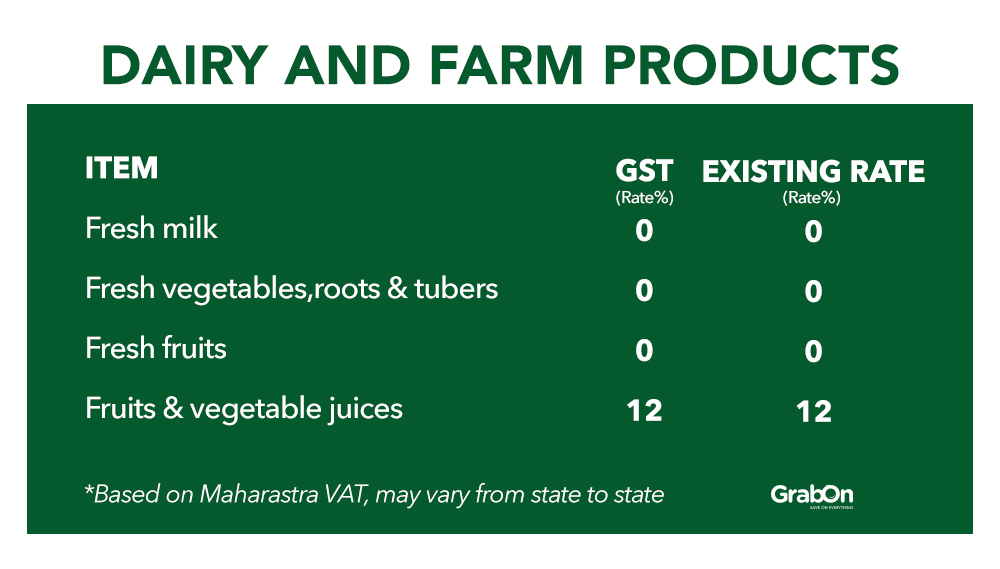

Under the Traditional Tax Regime, fresh agricultural produce like that of fruits and vegetables were exempt from taxes - VAT, excise duty, CST, etc. Services related to agricultural operations - supply of farm labor, the processes followed in the agricultural farms, packing, storage, loading, unloading, agricultural extension services, warehousing, etc have always been exempt from all kinds of Service Tax in India. Under the new tax regime which is GST, the tax rate on Fruits and Vegetables will be:

So, there will be no taxes on kind of fresh and unprocessed goods, which are bought directly from either agriculturists or retailers

The present rate of tax to be paid for this kind of food item is 5%

These food items too are currently under the 5% tax rate

With the introduction of the new GST, the market will be highly favourable for the agricultural industry. However, the 12 and 18% GST will make the market lots more unfavourable for the FMCG companies.

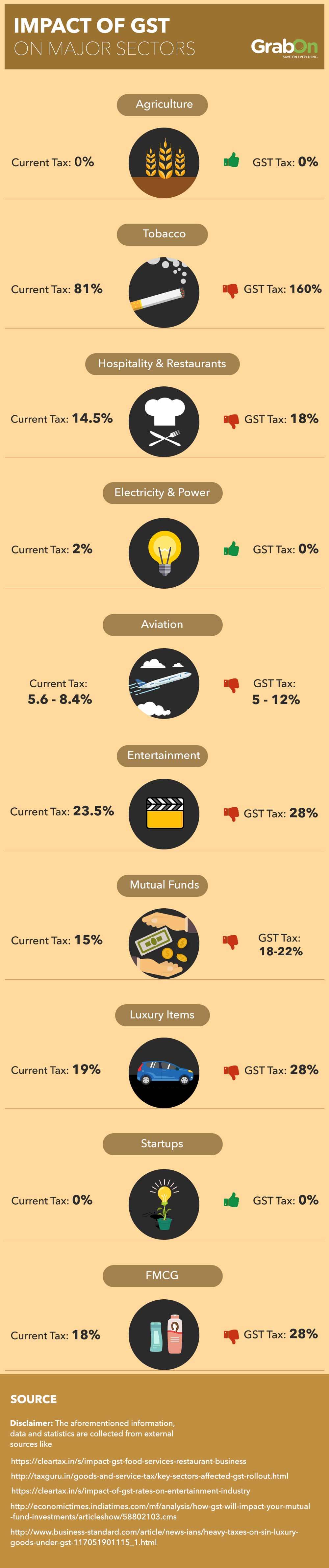

India is considered to be the second biggest consumer of tobacco, with a whopping number of 275 million users throughout the country. As a result, India also experiences the highest rate of oral cancer. To control this, the Indian government had revised the Excise Duty rates several times in the past decade. However, the locally manufactured bidi has mostly been exempt from the same till date. At present, the Excise Duty charged on manufacturing of tobacco based items are 64% on Cigarette, 22% on Bidi and 81% on Chewing Products. With the GST, things are going to change.

All kinds of tobacco related items that are manufactured will attract a tax of 28%. Besides this, there will be an additional cess charged on all kinds of tobacco products. For:

Although, the effect of this extra cess won’t make too large a difference for the tobacco industry, it is certainly going to be expensive for the consumers, which is a good thing.

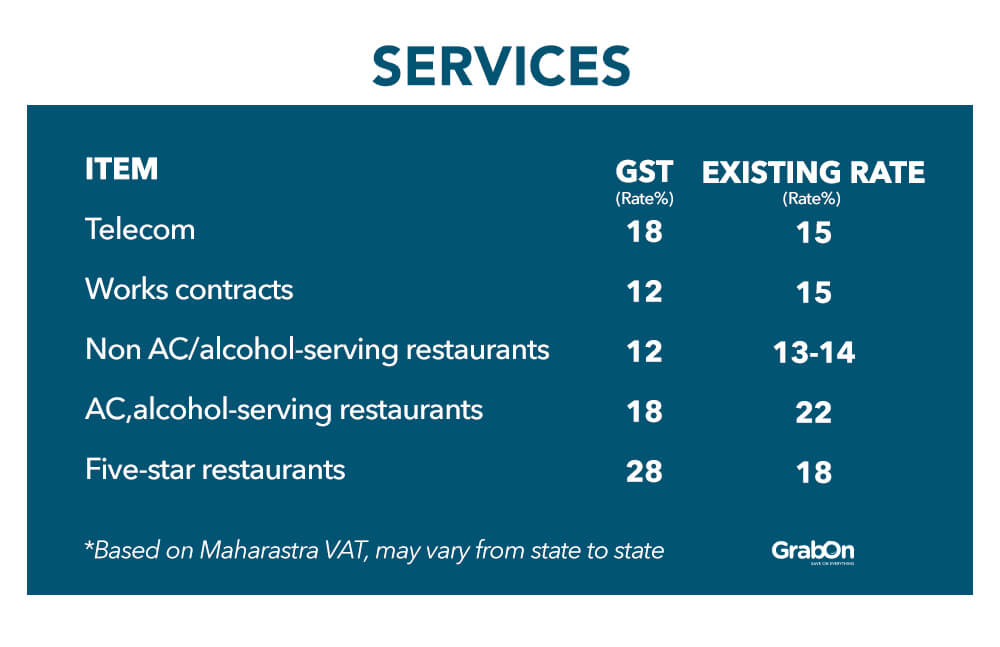

With the introduction of GST, operations for the hospitality sector and the restaurants are supposed to become more defined. The main problem that customers face at present at the restaurants is the multi-faceted tax payments, which gets added to the bill. These include the VAT of 12 to 14.5%, the service tax of 6% and the extra service charge (indirect taxes). As a result, consumers are required to pay more than he/she is actually supposed to. This definitely leaves a bitter aftertaste, is it not?

With the introduction of the GST this time, these will get consolidated into a single tax. However, the rate would be different for different establishments, which are:

The business experts has spelt out positive reviews regarding this change, however only time will tell if the newest tax regime is going to do good to the consumers or if it is going to be worse than before.

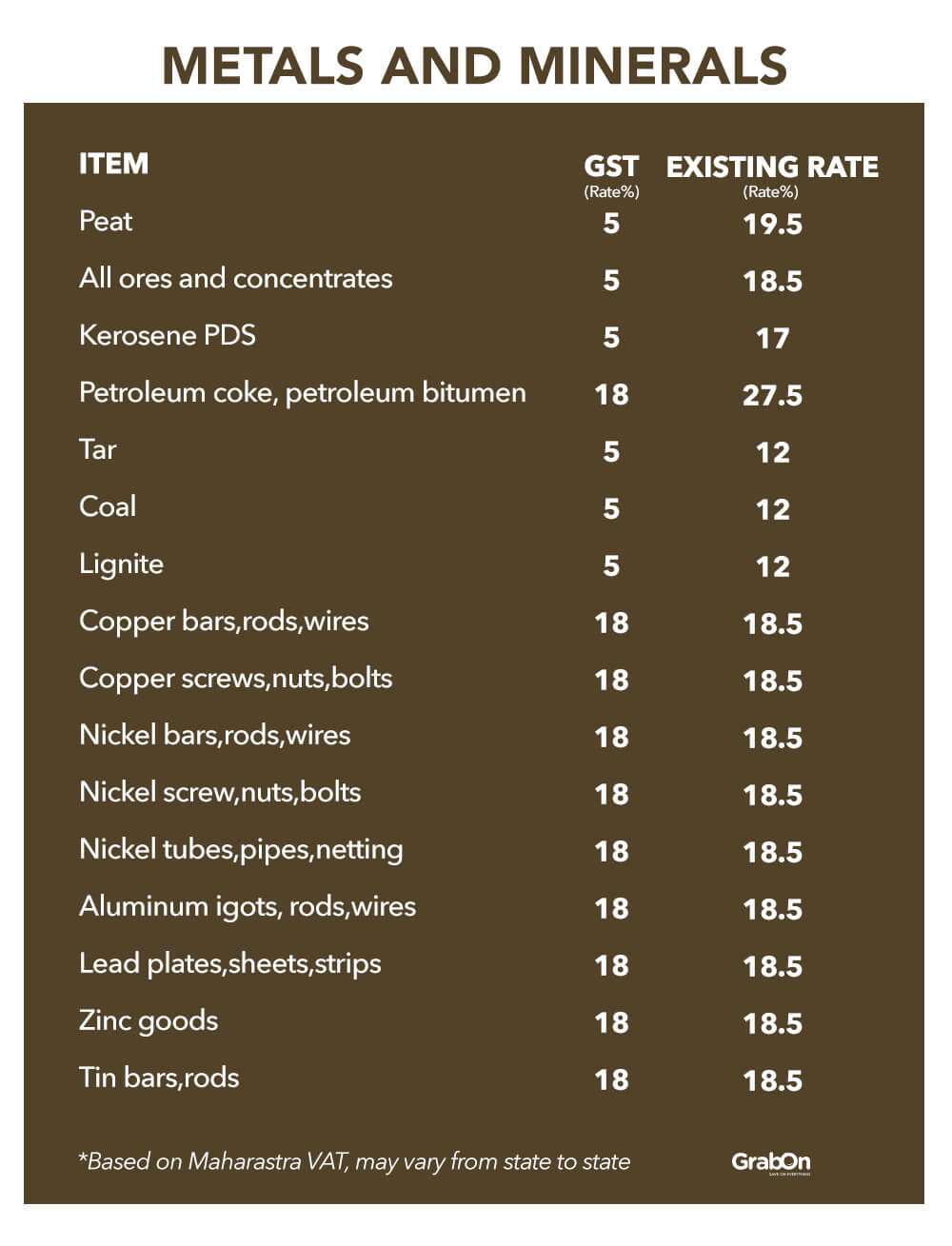

The electricity and power sector depends a lot on the coal, kerosene, bio-gas and other such kinds of fuel prices. And the best part about the soon to be rolled out GST tax regime is that coal, which is considered to be one of the major thermal sources for power generation, would fall under the lower slab GST. It will be taxed at 5 %, which is otherwise currently taxed at a rate of 11.7%. However, there will be additional cess charged on coal. As a result of the latest GST rates that would be introduced soon, the cost of coal is supposed to decrease by a considerable amount.

Besides the lowered cost of electricity, the decreased coal prices are also supposed to have a beneficial effect on the steel industry. This will be stabilising the cost of steel. It may also help in furthering the development of the production and goods industry as power plays a significant role in the same.

In a developing country like India, the Aviation industry is one of the most rapidly growing sectors and it reaps good profit every fiscal year. With the introduction of GST, the industry fears that it will lose out on a good amount of profit. Under the current Tax and VAT regime, the rates on ticket fares are as follows:

However, with the introduction of the GST rates list, the tax rates will be revised to:

This is definitely going to be easier on the pockets of the common man and the aviation industry is likely to experience increased sales post GST (in case of domestic flights).

Entertainment is a major part of our lives and most of the people are ready to shell out quite a good amount, when it comes to entertainment. So, how will GST affect this industry? Currently taxes on the entertainment industry are levied by the states, which averages at 30% and the range being in between 0 to 110%. State Wise list of entertainment tax at present:

| State | Entertainment Taxes |

|---|---|

| Maharashtra | 45% |

| Uttar Pradesh | 60% |

| Karnataka | 30% |

| West Bengal | 30% |

| Assam | 15% on tickets priced below Rs. 20 and 20% on tickets priced above Rs. 20 |

| Tamil Nadu | 15% (no tax on Tamil movies) |

| Rajasthan, Jammu &Kashmir, Himachal Pradesh and Punjab | 0% |

| Jharkhand | 110% (0 for Jharkhand movies) |

As for the food items bought at places of entertainment, the service tax charged are:

| VAT | 14.5% |

| Service Tax | 9% |

| Total Tax | 23.5% |

The latest GST rates in India, which will be introduced soon is going to change all of these. Take a look how:

| Types Of Entertainment | GST Rates |

|---|---|

| Circus | 18% |

| Drama | |

| Theatr | |

| Indian Classical Dance including Folk | |

| Cinema | 28% |

| Movie Festivals | |

| Casinos | |

| Amusement Parks |

The Service Tax on food and beverage will come down from 23.5% to 18%, which means the cost of going to a movie will be lower in the near future.

Luxury Items are costly and that is why the name. No doubt, these kind of products will attract higher tax brackets. The soon to be implemented GST rates in India will make luxury items costlier for you. Let us see HOW:

The GST tax slab for the luxury items is going to be 28%

As per the proposed GST regulations, the CESS cap on luxury goods will be 15% (additional to the GST slab)

There can be surges on this CESS rate and as a result, the GST rate can even go upto 43%

However, the most surprising part in this category are the products, which have been included under it. For example, products that were considered to be essential commodities previously have now been out under the list of luxury goods. These are shampoos, after shaving gel, shaving foams, butter, mustard, coffee and all other kinds of condiments. The fact that yachts, private jets and even mobiles (considering today’s choice of smartphones) are considered to be luxury items is relatable, but that shampoos and shaving items or even butter can find a place in this list is surprising!

The effect of GST on the Mutual Fund industry is going to be quite big and definitely it is not going to be easy either for those offering the investment services or for the investors in any way. But yes, the consumers may have to pay more than what they do now. At present, the service tax levied on mutual Fund investments is 15%. Till now there has been no concrete data on the tax percentage. However, as per reports:

The tax to be levied may range in between the 18 to 22 percent tax bracket.

GST is supposed to bring a radical change in the market involving small businesses and ecommerce, actually for good. The reasons for it are HERE:

Revenue system will get simpler - At present startups are required to spend a good amount of time on managing taxes at various levels. GST simplifies this entire procedure, thereby helping startups find more time for business management.

Both sales and services taxation will be consolidated - At present, VAT and service tax for sales and services are separate. So, if an establishment such as a restaurant deals in both sales and services, the total tax to be paid shoots up by a considerable amount. With GST, everything is going to be consolidated.

New businesses will enjoy higher exemptions - GST increased the turnover value of startups from 5 lakhs to 10 lakhs who needs to get VAT enlistment and pay the same. And for those who have a turnover in between Rs. 10 to Rs. 50 lakhs, will enjoy lower tax rates.

Higher liquidity values - For most of the startups liquidity has been an issue, always. With GST, getting funding would be easier for the otherwise bootstrapped companies.

Cost and time required for logistics will reduce - GST will remove the cascading effect of tax, which will help in the interstate development of transportation of goods as well. This will reduce the cost of the logistics and the time for it as well.

So, starting and managing a business is going to get simpler with GST.

Under the current tax regime, the taxes are levied by both the state and central government at different points, which is a highly complex system. And as a result, most of the taxpayers end up paying more than what is expected. For example, when a dress is manufactured, the central government collects indirect taxes on the same. And when a customer buys the dress, the state government levies taxes, eventually making the product costlier for the customer. GST looks to eliminate this cascading effect of tax. If you are a business, the elimination of the cascading effect of tax is definitely going to help you. As for the customers, GST will definitely prove to be helpful as the final price of goods will be lowered considerably.

However, everything has something good and bad in it and GST is no different. Although, a uniform tax system will be followed throughout the country once GST rolls out, it may have its fresh set of complexities. What will these be that only time can tell. But, as of now GST is going to help you, irrespective of you being a consumer of product and service provider.

GST tax rates : Category and Item Wise

The SERVICES that fall under this category are: l Grandfathering services l Hotels and lodges that cost less than Rs. 1000 However, Rough semi-precious and precious stones will attract a GST rate of 0.25%.

The SERVICES that fall under this category are:

E-commerce is one of the fastest moving industries in India today. It gained an extra amount of traction with the introduction of the demonetisation policy by the Indian government. Whether it is going to profit from the introduction of the newest GST rules is a debatable question. Goods and services tax regime is looking to do away with the notoriety associated with the indirect tax policies. With its introduction of GST, there will be a fundamental change in the business process.

| Party | Current Tax Regime | GST Regime | Impact |

|---|---|---|---|

| Online stores | The online stores charge a service tax from the vendor on facilitation services. So, the online stores can avail a service tax credit against such input services. | The online stores may charge CGST+SGST or IGST based on the transaction type. And these taxes will then be available as credit for the vendor. | There can be higher tax rates on the output The output taxes on services would be creditable to the seller The online stores can claim all the taxes on the input side Centralized registration will go out of the window. Now, stores may have to go through multiple registrations Product pricing will be determined based on the relation between the tax rate and the credits |

The challenges that e-commerce companies amy face are:

However, there will be a considerable decrease in the costs of managing an online business as the cascading tax effect will be eliminated. It will also be less stressful to work together as the taxation system is going to be clear than ever, be it on the expenses collected or the web based exchanges made by the businesses.

In the past decade and more, India has come to be recognised as one of the greatest hubs for the budding entrepreneurs. However, starting a business is definitely not an easy task. And even if you do, with all the compliance related tasks, logistics and then the taxes, the whole process becomes really stressful. As the GST is going to be rolled out soon, it is supposed to make the logistics process, taxation and more easier for the startups. So, let us see how:

The challenges of GST for the startups:

GST has been designed to help the economy. However, only time can tell if it is going to help in the growth of the economy or not. There might not be any immediate jump in the growth of the economy, though it is expected that GST will eventually provide a boost in the financial ongoings of our country. According to DK Joshi, the chief economist of Crisil, mentioned the probable effect of GST on our economy, which is - “It’s not optimal, but let the best not be the enemy of the good. Even with its imperfections, it could usher in significant benefits, especially through a quantum leap in transaction trails and logistical efficiencies.” What will be the immediate effects of Goods and Services Tax on the Indian economy:

After a time period of sixteen years, the Indian government is here with the all new GST (goods and services tax) which is going to be implemented from July 1st, 2017. In simple terms, it is the all new indirect tax which will be collected on everything right from daily household item to the expensive luxury cars. The implementation of GST will be on everything irrespective of the products. So, here is the modern system of tax which is very transparent, clear and not complicated. These tax will generate the revenue which the country needs for the development and implementation of the new rules and plans.

This new GST system is the amalgamation of the old taxes in a different format. GST is going to be implemented on more than 1200 categories of goods and services, where the tax slabs are at 0%, 5%, 12%, 18% and 28%. There are certainly other products that fall under the special category of taxes where the additional cess will be applied. The luxury products, tobacco, aerated drinks are falling under this category. And an essential goods and services like Electricity and real estate are going to remain the same. And over half of the items will be taxed at 18% or 28% of GST. The GST will be imposed at 18% on essential products like soaps and washing soaps. It will be high in the pockets of the movie buffs where they are going to pay 18% GST and on some other movies, it is going to be 28% depending on the price of a cinema ticket.

This GST is going to be rolled out in 29 states including the seven union territories. There will be no more VAT implemented on any goods and services. The centre and state government taxes will be waived off. Moreover, every state will impose a tax and will decide how much GST should be collected on any particular goods and services. All the confusions regarding the same GST will be cleared in few days.

GST or goods and services tax is going to bring a paradigm shift in the Indian economy and the financial status of the people and organizations in the country. But, tax has always been a complex affair. So, the Central Board of Excise and Customs has tried answering all your queries so that you can have all your doubts cleared.

GST is applicable only when the aggregate turnover (any form of income made through provision of goods or services) is more than Rs. 20 lakhs (The aggregate turnover amount is Rs. 10 lacs in 11 of the special category states). In order to calculate the aggregate, turnover of all supplies will be taken into consideration.

Irrespective of the turnover amount, any person dealing in100% exempted items is not liable for GST. So, registration can be given a miss.

As said before, irrespective of the aggregate turnover, if a person is dealing in either completely exempt goods or services, he/she will not be liable to register under GST.

In case you register, irrespective of the turnover amount, you would be considered as any other taxable person.

This query can be cleared by referring to Section 2(6) of the CGST Act. The calculation of aggregate turnover is not supposed to include the value of the inward supplies. The tax on this is payable on the basis of reverse charge.

A new registration will have to be done as the partnership firm is supposed to have a new PAN.

In case the aggregate turnover (all over in India) is more than Rs. 20 lakhs or if the business involves inter-state supplies, he or she would be liable to register.

Provisional GSTIN (PID) will be converted into a new GSTIN within a period of 90 days. Till that time, the provisional GSTIN can be used. The new GSTIN and PID would be the same.

If a person deals in 100% supply of goods that are not a part of GST, no registration will be required.

For understanding the term “not liable to tax ”, please refer Section 2(78) of the CGST Act. It means the supplies that are not leviable under the CGST/SGST/IGST Act.

A civil contractor is a supplier of service. He/she needs to register at the place from where he/she is offering the services.

Only the outward supplies against which tax is to be paid on the reverse charge basis by the recipient shall be included for aggregating the final turnover of the supplier.

To understand this query, please refer proviso to rule 8(1) of CGST Rules. All SEZs under same PAN within the same state require a single registration.

Suppliers who deal in supplies against which the recipient is liable to discharge the GST under RCM, can enjoy an exemption from registration.

If the services are being provided from Nasik, registration in Maharashtra and IGST on inter-state supplies is required.

A new and separate registration for ISD is required. New registrations will open from 0800 hrs. on the 25.06.2017.

It can be added when you will be filling FORM REG-26 to convert the provisional ID to the final registration.

The conversion can be done while you will be filling FORM REG-26 for the purpose of converting your provisional ID to the final registration.

A separate registration for the tax deductor will be required.

A single registration is required per State for all the activities involved.

Any person who deals in interstate supply that is taxable requires registration. So, in this case it is not you, but the AP dealer who needs to take registration and make the tax payments.

No, there is no area based exemptions under GST.

Only if any supply from Delhi is involved, you need to register in Delhi. Otherwise, Mumbai registration will be sufficient (IGST payment on supplies needs to be made from Mumbai to Delhi)

Any unregistered person has a 30 day time period to complete the registration formalities, starting from the date of liability to the obtainment of registration.

Apply for a cancellation of the Provisional ID on or before the 31st of July, 2017.

No, it won ’t be.

You can apply for the new registration at the GST Portal gst.gov.in from 0800 hrs. on the 25th of June 2017.

All refunds under the earlier laws will be given with respect to the earlier laws.

Appropriate provisions are in place and it involves provision for grant of 90 per cent refund on the provisional basis within a period of 7 days from the date of filing the registration.

The Clean Environmental Cess on coal will get replaced by the GST Compensation Cess.

Yes, you will have to pay tax on the reverse charge basis for the supplies from an unregistered person.

IGST and GST compensation cess has to be paid i.e. customs duty + customs cess + value of imported goods.

Export to Nepal will follow the same GST rules as export to any other country.

The supplies to SEZs are rated at 0 as defined in the section 16 of IGST Act.

The supply of goods to SEZs is rated at 0 and the supplies from SEZs are considered imports.

It is rate at 0 in most countries. Place Of Supply (POS) for the transport of goods is determinable under section 12(8) or section 13(8) of the IGST Act, 2017. It depends upon the location of the service provider or receiver. Exports are treated 0 rated supplies.

Supply of product from SEZ is considered import and under the present system a Countervailing Duty or CVD will have to be paid and under GST that will be replaced by IGST.

In the current scenario, the importer pays both CVD or Countervailing Duties and BCD or Basic Customs Duty. Supply from SEZ is treated as import and in place of CVD, IGST will be levied.

No, the State GST of one state can ’t be used to pay off the output tax liability of another.

The Central GST and State GST credit for a state can be used to payment the GST liability of that state alone, provided you have the same GSTIN.

Tax will be levied and collected by the state where the deal is made. The supplier will then collect IGST and the buyer will receive GST credit.

The company needs to refer to the Input Tax Credit Rules for reversal of credit while providing exempted and non-exempted supplies.

Just like in the case of invoice, the credit/debit notes of the unregistered individual has to be provided by an already registered person. The GSTR2 gives you provision for reporting the same by the recipient.

The seller can issue one tax invoice for the taxable items and clearly mention the exempted good in the same invoice.

No, under the GST act there is no such requirement for you to take down the Aadhaar / PAN details of the customer you ’re dealing with.

Yes, all the expenses need to be included in value and the invoice needs to be issued according to that. Kindly refer to Section 15 of CGST Act and Invoice Rules.

Depends on what type of goods are in use. If they need to be provided during construction, then yes an invoice is a must. However, if they are tools that are to be used during construction then the delivery challan should be issued.

Under GST, the supplier or manufacturer might provide credit notes to the customer in turn adjusting his liability.

You need to issue the RCM liabilities tax invoice on self.

The Advance amount will be adjusted in return.

Usually there is no requirement to upload any of the documents. But if it is required in the case of inter-State supplies, they have to provide the invoice value of more than Rs 2.50 lakh.

Returns provide for furnishing rate wise details.

It will be decided where Rs 5,000 per day exemption is given with respect of supplies received from unregistered person. For any other supplies above the stated amount, a monthly consolidated bill can be raised.

The Tax will be charged only on the total price of the goods which are charged for the supply.

Any person who is making inter-state supply has to mandatorily obtain registration. Also, any in such cases, section 9(4) will not come into play.

The Stipend which is paid to interns will considered under the employer-employee transactions. Hence, not liable for GST.

Salary will not be liable for GST.

As per the rules, it has been decided that rs. 5,000 per day is the exemption given in respect of supplies received from unregistered person.

Tax will be decided on considering the supply received.

GST will only be levied considering the value charged for the supply only.

If the goods are supposed to be disposed it will be considered as a supply.

Generally there will be two supplies where the supplier from MP will charge IGST from the recipient in Maharashtra. Whereas, the service provider in Maharashtra will charge IGST from the recipient in MP.

Intra-state supply and CGST / SGST will be applicable only when the place of supply and the location of the supplier are in same state.

There are three different statutes and are required to be separately accounted for three different levies.

When it comes to the ITC exempt supply it includes Nil rated which is taxable at zero per cent and non-taxable supplies and no ITC is available only for the such supplies.

In general terms, the professional tax is not a tax on supply of goods or services. Professional tax not subsumed in GST.

In such cases, the value of the goods will be estimated and no GST will apply till value of such gifts exceeds Rs 50,000 in a financial year.

Composite supply will be defined by the Section 2(30). When it comes to the treatment for tax rate etc will be that of principal supply that is stated in Section 8.

It will be treated as the normal supply.

Partners are not considered as the employees of the firm and the salary will not be leviable of GST.

By filling the respective forms under transition rules upto September 30, 2017, Transition credit can be availed.

The areas which are based exemptions cannot be continued under GST. Those will be operated through the route of reimbursement as prescribed.

The dealer can waive a deemed credit at the rate of 40 per cent / 60 per cent of the CGST. This will be paid on supply of such goods in GST. If the goods are branded and generally if they are greater than Rs 25,000, full credit using CTD can be availed.

Yes, deemed credit can be available subject to satisfaction of other conditions as prescribed.

Under the Section 140(3) of the CGST Act, full transition credit of such duty will be available on stock in hand.

Full transition credit of such duty will be available on stock in hands under Section 140(3) of the CGST Act.

Full transition credit of such duty will be available on stock in hand under Section 140(3) of the CGST Act.

Full transition credit of such duty will be available on stock in hand under Section 140(3) of the CGST Act.

The supplier can go ahead to proceed the carry forward the closing balance of ITC from VAT return for June 17.

The supplier will be eligible to carry forward ITC on such stock from VAT return for June 17.

Refund claimed under existing law will be handled as per the provisions of the existing law. Form C to be submitted in terms of provision of Rule 1(1) of Transition Rules.

If the invoice is generated after appointed date, then GST will be chargeable on such supply.

No provision will be given in such credit as per the GST law.

The Balance VAT credit will be transferred to new provisional ID as SGST Credit.

There is no Form H in GST.

The closing ITC in VAT return will be eligible to carry forward the GST.

For whatever may be the inputs, the duty which is paying for the documents available with respect to CGST/SGST credit will be available. But credit of CST will not be available.

Yes, deemed credit can be available subject to satisfaction of other conditions as prescribed.

There is no such provision in GST.

No.

There is no Clean Energy Cess on coal. Where as coal will be subjected to the compensation cess at the rate of Rs 400 per tonne.

Under Section 140 of the CGST Act, there will be no more carried forward in GST as it is not covered by definition of "eligible duties and taxes".

As per the GST, deemed credit will be available for all stocks which was procured within one year period.

From the appointed day it will be three months to declare the transition credit forms. Please refer to transition rules for more details.

Yes. For all supplies within the Andaman and Nicobar Islands, CGST plus UTGST would be levied.

IGST will be levied only once.

GST will not affect this fee as it does not concern the same.

The current system for the E-way Bill in the states will continue the way in which the E-Way Bill procedures are finalised.

Yes, there is sunset clause for the Anti-profiteering Authority and it is of two years.

Pavan Teja K

pavan@grabon.in

+91 - 9818727884